May kicked off with high tension in the crypto market — and there’s no shortage of reasons why.

The SEC once again postponed its decision on the Litecoin ETF, but what initially looked like bad news turned into a trigger: LTC dropped and then quickly jumped over 10%, pushing trading volume higher.

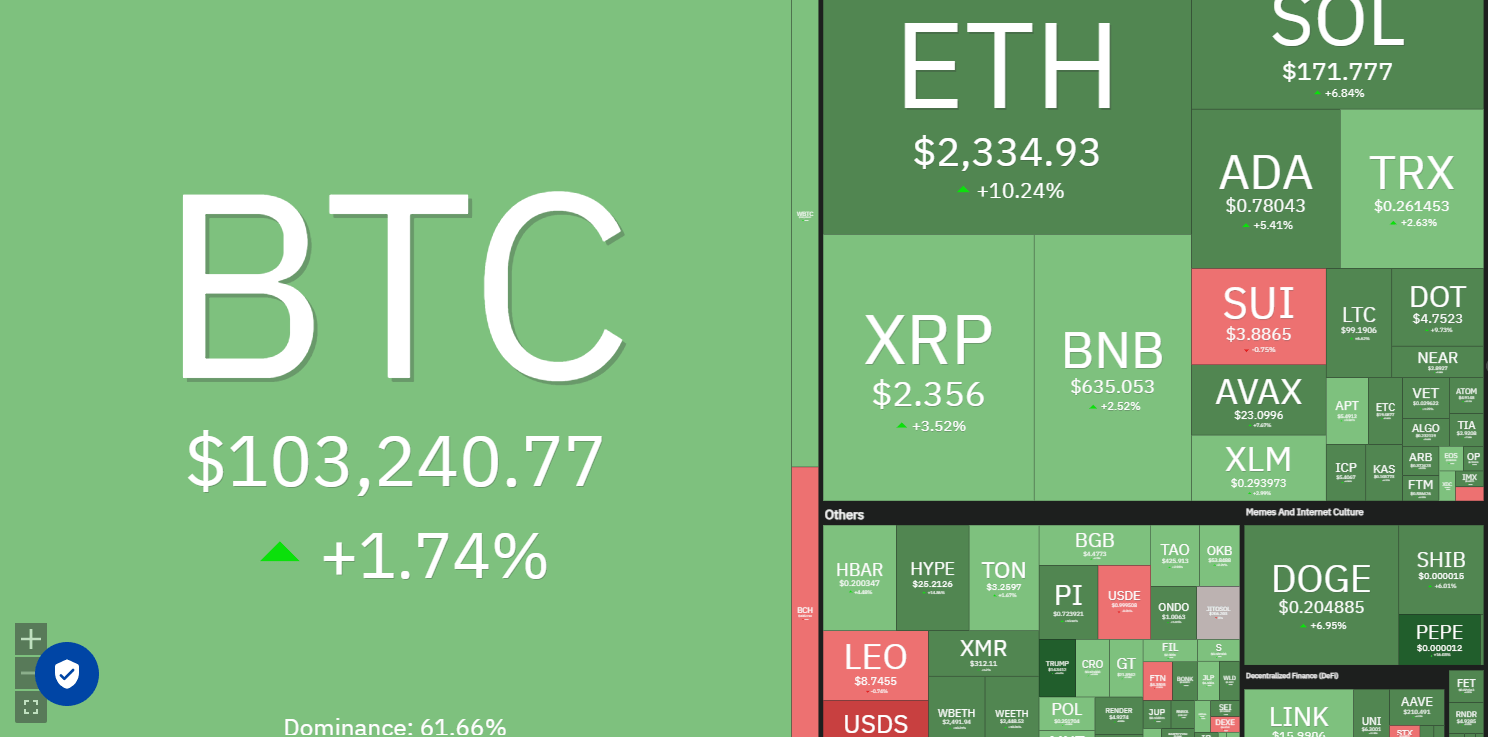

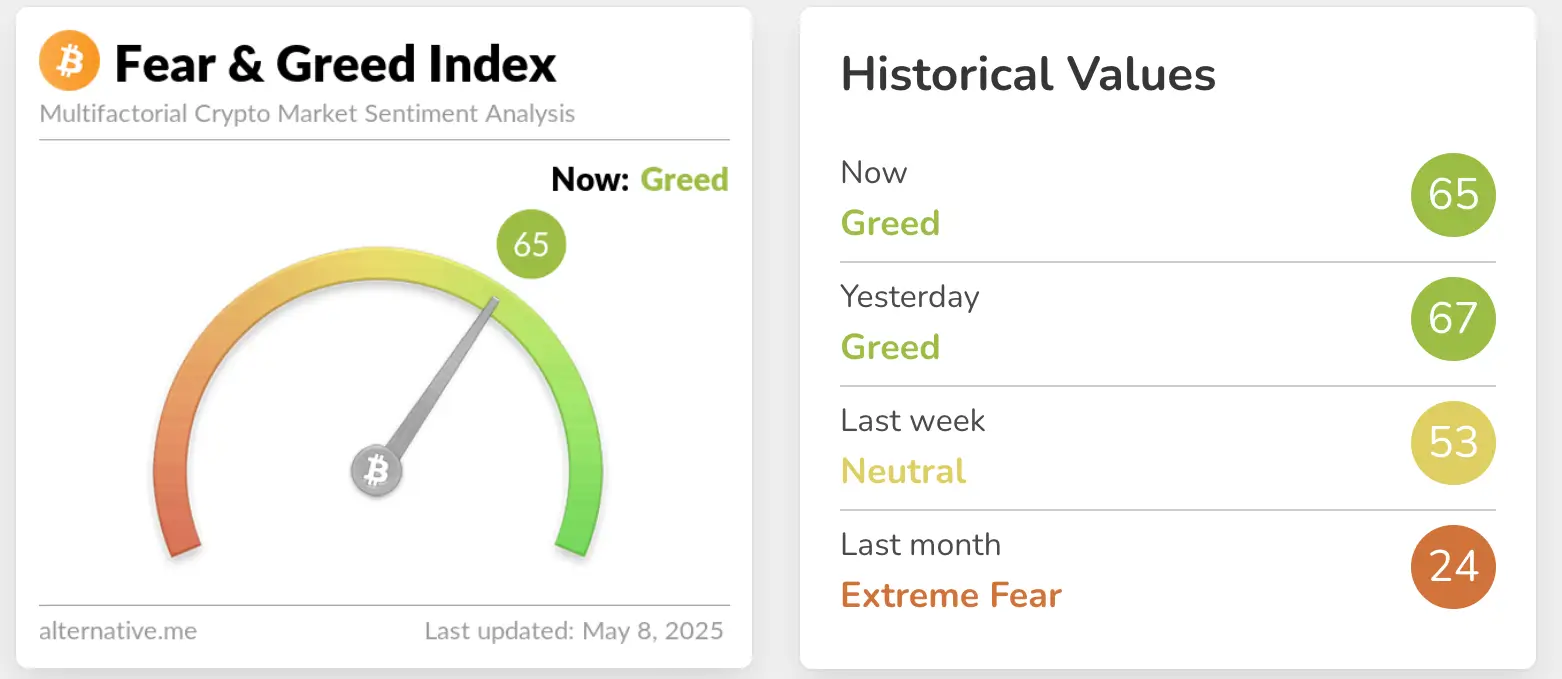

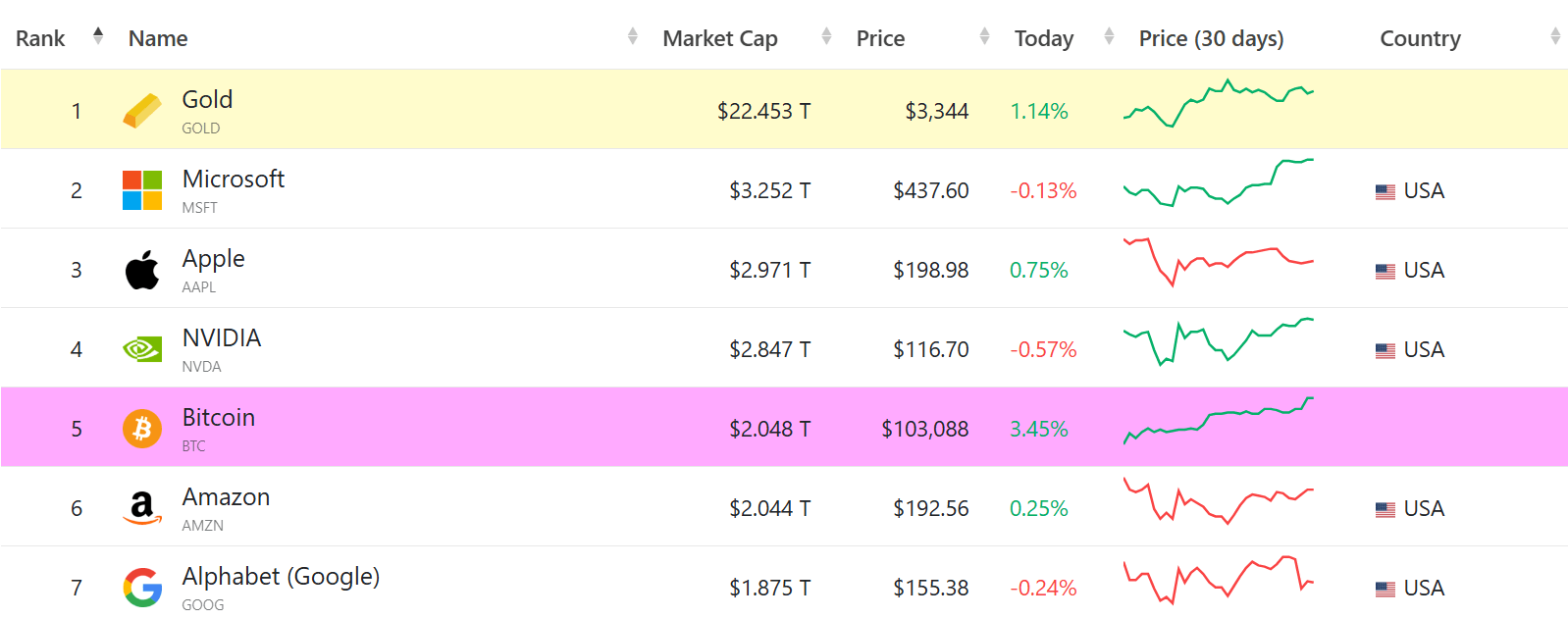

Meanwhile, Bitcoin is back in the spotlight: it surpassed $100,000, returned to the “greed” zone on the Fear and Greed Index and — to seal the moment — overtook Amazon in market cap, becoming the 5th most valuable asset in the world.

And that’s not all: Solana now supports Wrapped Bitcoin (WBTC), Kyrgyzstan wants to build a crypto reserve with backing from Binance’s co-founder, and New Hampshire took the lead by officially approving the use of BTC in public funds.

In this article, you’ll find everything that’s moving the market right now — and why these developments could shape the next steps for the entire sector.

Litecoin ETF Delayed by the SEC

Source: Coinbay

On May 5, the U.S. Securities and Exchange Commission (SEC) postponed its decision on the Litecoin ETF filed by Canary Capital.

Analysts had viewed LTC as one of the stronger candidates for early approval among the more than 70 pending crypto ETF applications — especially after the newly appointed SEC chair stated that he would prioritize reviewing these filings.

Within 24 hours of the announcement, Litecoin dropped 4%, trading at $81.

Litecoin Jumps 10% After SEC Delay

The bullish rebound came right after LTC hit $81.03 — its lowest level in two weeks — in reaction to the SEC’s latest delay.

After that, the asset bounced back strongly, reaching $91.68 and surpassing $850 million in daily trading volume.

The move defied bearish expectations and reignited investor interest, but experts warn of technical signals and on-chain data pointing to a potential short-term reversal.

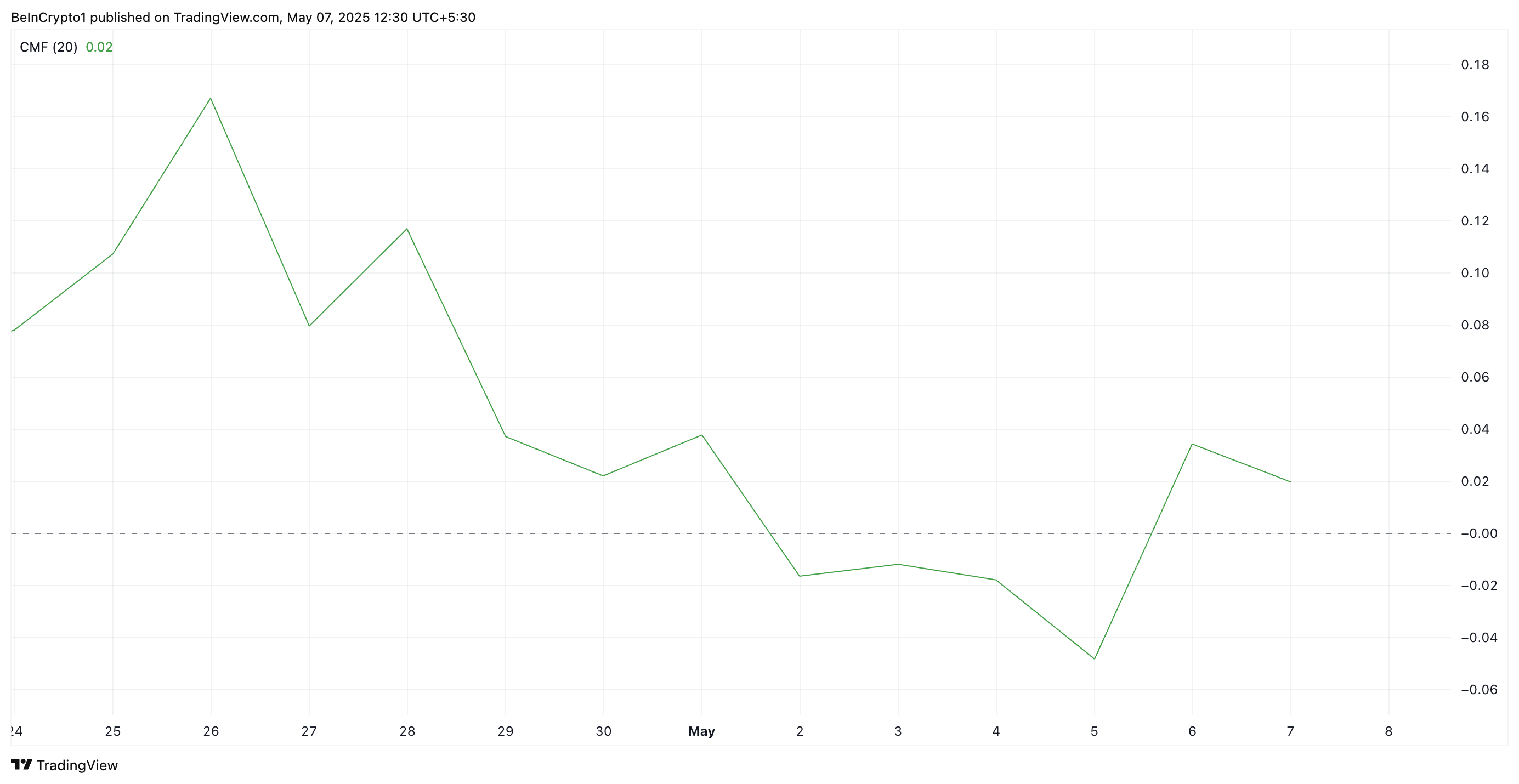

Despite LTC’s rally, the Chaikin Money Flow (CMF) — which gauges buying and selling pressure — turned negative. Daily chart readings show the CMF declining and approaching the zero line, signaling weakening buying momentum.

Litecoin CMF. Source: TradingView

A bearish divergence in the CMF occurs when the price rises, but the indicator starts to fall. This signals that buying pressure is weakening even as the price goes up.

In Litecoin’s case, this could point to a potential drop or a loss of momentum in its upward movement.

Solana Now Supports Wrapped Bitcoin (WBTC)

Source: Bankless Times

On May 5, 2025, the Solana network took a strategic step forward by integrating Wrapped Bitcoin (WBTC), expanding the utility of BTC in high-performance decentralized applications.

The integration was made possible through the Wormhole protocol, which facilitates interoperability between Solana and Ethereum.

Below, we explain how this integration works, its impact on the DeFi ecosystem, and how to start using WBTC on Solana.

What Is WBTC?

Wrapped Bitcoin (WBTC) is a tokenized version of Bitcoin pegged 1:1 to BTC, originally designed for use on the Ethereum blockchain.

It allows users to transfer the value of Bitcoin across blockchains that support smart contracts — like Ethereum, and now Solana.

With this integration, Solana joins the list of networks offering native support for WBTC, increasing liquidity and opening up new opportunities for users and developers.

How Does WBTC Work on Solana?

According to Bankless Times (2025), WBTC support on Solana was made possible via the Wormhole protocol, which acts as a bridge between different blockchain networks.

Here’s how the process works:

- Users deposit BTC to receive tokenized WBTC.

- That WBTC can then be moved, swapped, or used directly in Solana-based DeFi apps.

- All with low fees and fast transactions — hallmarks of the Solana network.

Why Does This Matter?

The arrival of WBTC on Solana brings several strategic benefits:

- BTC Access to DeFi: Users can deploy Bitcoin value across Solana protocols like Orca, Jupiter, and MarginFi.

- Low Fees and Scalability: Unlike Ethereum, Solana offers faster and cheaper transactions.

- More Liquidity for the Ecosystem: WBTC brings added capital to lending platforms, DEXs, and liquidity pools on Solana.

Beyond WBTC, Solana now also supports other Bitcoin-based tokens like tBTC and cbBTC (Coinbase Wrapped BTC), further expanding investment options, as highlighted by Bankless Times.

And importantly, unlike traditional bridges, the Wormhole protocol ensures secure custody of BTC during the conversion process.

Bitcoin Reacts to Fed’s Rate Decision and Trump’s Pressure for Cuts

Source: Cointelegraph

On May 7, the Federal Reserve chose to keep interest rates steady between 4.25% and 4.50%, citing rising risks of unemployment and inflation — despite mounting pressure from President Donald Trump for aggressive rate cuts.

Fed Chair Jerome Powell stated that while inflation has declined significantly, it remains above the central bank’s 2% target. He also noted that surveys of households and businesses show a sharp drop in economic sentiment, largely driven by concerns over Trump’s trade policies.

The central bank justified its decision by pointing to potential risks of rising unemployment and a slowing economy. However, Powell also emphasized that the job market remains strong, with unemployment at or near its lowest sustainable level.

Market analysts now expect the Fed to cut the benchmark interest rate to around 3.6% by the end of 2025.

Why Is Bitcoin Rising Despite High Interest Rates?

Chart showing Bitcoin’s drop to $96,000 before rebounding above $98,000 just a few hours later on May 7. Source: CoinMarketCap

Bitcoin’s recovery followed a brief dip to $95,866 shortly after the Fed’s announcement. However, the market quickly rebounded, pushing BTC back above $98,000 — its highest level since February 21.

By the time of this writing, Bitcoin is worth $102,939.97

Here are the main drivers behind the price surge:

- Market Sentiment Is Improving: The Fear and Greed Index has returned to the “greed” zone, reflecting renewed investor confidence.

- Strong Inflows into Bitcoin ETFs: Since March 26, Bitcoin ETFs have seen over $4.41 billion in positive inflows, signaling robust institutional demand.

- Expectations of Future Rate Cuts: Although the Fed held rates steady, there’s growing speculation that it may reverse course if job and inflation data worsen in the coming months.

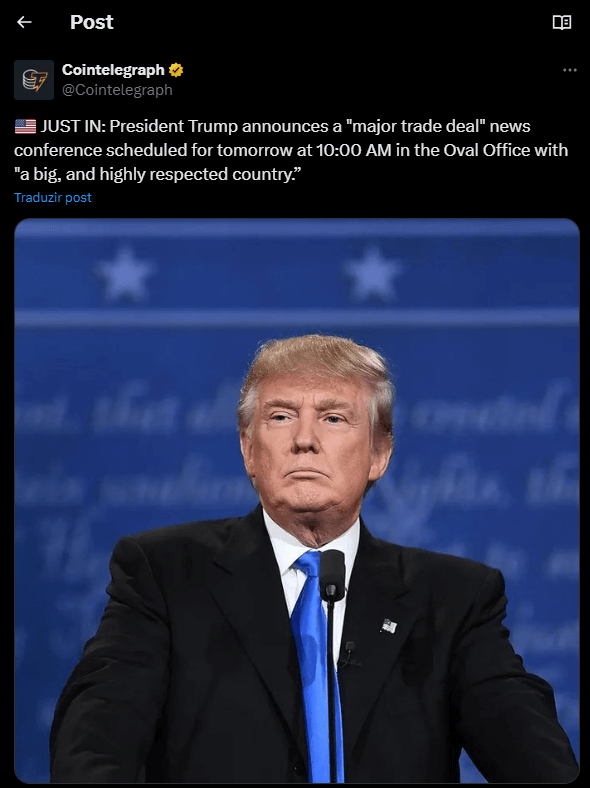

Historic Trade Deal Between the U.S. and U.K. Set to Boost American Exports

Source: X

On May 8, 2025, U.S. President Donald J. Trump and U.K. Prime Minister Keir Starmer announced a new trade agreement between the United States and the United Kingdom.

The deal aims to expand market access for American exporters, reduce tariff barriers, and strengthen strategic supply chains.

In addition to the U.K. deal, the U.S. is expected to meet with Chinese officials in Switzerland on May 10.

Key Points of the U.S.–U.K. Trade Agreement

- Expanded Agricultural Exports

The U.K. will eliminate non-tariff barriers, allowing increased imports of U.S. agricultural goods such as ethanol and beef, totaling over $950 million. - New Vehicle Tariff System

Up to 100,000 British cars imported annually will face a 10% tariff; any additional units will be taxed at 25%. - New Steel and Aluminum Framework

Both countries are negotiating a cooperative system to replace current tariffs and address global overproduction. - Strategic Supply Chains

The deal prioritizes U.S. access to U.K. components in aerospace and pharmaceuticals, reinforcing the resilience of key production chains. - 10% Reciprocal Tariff

Since April 2025, most traded goods between the two countries are subject to a reciprocal 10% tariff, providing greater predictability for businesses.

Impact on Bitcoin

Bitcoin surged past $100,000 following President Trump’s announcement of the trade deal with the U.K., which may include the removal of the flat 10% tariff on all imports.

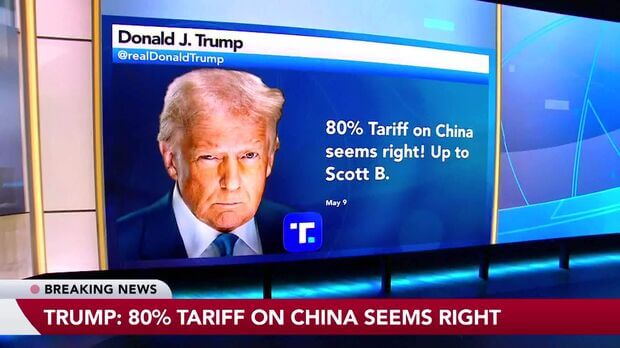

Trump Backs 80% Tariff on Chinese Imports

Source: Bloomberg

On May 9, 2025, President Donald Trump publicly stated that an 80% tariff on Chinese imports “seems right,” reinforcing his tough stance on trade with China while hinting at a possible recalibration of the current 145% tariff.

This marks the first time the president has proposed a specific new tariff rate, just days before a high-level U.S.–China trade meeting scheduled to take place in Switzerland.

Trump stressed that China must open its domestic market to American companies as a condition for any tariff relief. In his words, a fair deal requires reciprocity — and “China still has a long way to go” on that front.

The message was clear: tariff reductions will not happen without meaningful economic reform from China.

Market Response and Economic Impact

Markets reacted cautiously to the announcement. Potential positive outcomes include:

- Lower prices for U.S. businesses and consumers

- Reduced inflationary pressure on imports

- Smoother supply chain operations

Still, uncertainty lingers. Trade experts warn that without significant structural reforms from China — such as broader market access and stronger intellectual property protections — high tariffs from the U.S. are likely to remain in place.

Crypto Market Surpasses $3 Trillion in Market Cap

Source: Coin360

The cryptocurrency market is seeing a strong rebound today, with total market capitalization surpassing $3 trillion for the first time in over two months.

This marks a 30% increase from recent lows, driven by a combination of macroeconomic signals and bullish technical patterns.

What’s Driving the Rally?

- Fed Holds Rates Steady Amid Stagflation Concerns

With inflation remaining stubborn and economic growth slowing, investors are turning to Bitcoin (BTC) as a potential hedge against inflation and a store of value — thanks to its fixed supply and decentralized model. - Market Optimism Around the U.S.–U.K. Trade Deal

Hopes of easing trade tensions have boosted broader markets — including crypto — fueling expectations of stronger global economic cooperation. - Technical Recovery Fuels Bullish Momentum

From a technical perspective, the total crypto market cap surged sharply off the $2.4 trillion support zone. The daily Relative Strength Index (RSI) also bounced back from oversold levels, signaling renewed buying strength.

This suggests many investors were waiting for a clearer signal before re-entering the market — triggering a wave of inflows once key price levels were breached.

Leading Cryptocurrencies Fuel Market Momentum

The rally is being led by the top-performing assets:

- Bitcoin (BTC): Bitcoin price has surged past $102,000, reaching a market capitalization of approximately $2.04 trillion and maintaining a dominant 61.64% share of the crypto market.

- Ethereum (ETH): Ethereum price also saw significant gains, stabilizing above $2,333 with a market cap of around $281,73 billion.

These movements have pushed the Crypto Fear and Greed Index into the “Greed” zone, signaling growing investor optimism.

Bitcoin Above $101K: What Does It Mean?

Crypto Fear and Greed Index. Source: Alternative.me

On May 8, Bitcoin crossed the $101,000 mark, recording its highest price in over three months.

The 4.6% daily increase triggered $205 million in short liquidations, effectively wiping out a large portion of outstanding put options — reinforcing bullish sentiment across the market.

Ethereum Activates Pectra Upgrade

Source: Coin Edition

On May 7, 2025, the Ethereum blockchain took another major step toward greater scalability and usability with the activation of the Pectra upgrade.

Considered the most significant transformation since The Merge, Pectra combines two core enhancements: Prague (on the execution layer) and Electra (on the consensus layer), introducing 11 new Ethereum Improvement Proposals (EIPs).

The Pectra Upgrade is a dual update that brings major changes to both transaction execution and network consensus on Ethereum. Its main goals are to enhance user experience, optimize the staking system, and boost scalability through rollups and layer 2 solutions.

Key Changes Introduced by the Pectra Upgrade

1. EIP-7702: Smart Accounts for Everyone

With EIP-7702, traditional wallets (Externally Owned Accounts – EOAs) can temporarily behave like smart contracts. This enables powerful features such as:

- Fee sponsorship by third parties

- Delegated permissions for safer operations

- Custom transaction validation

This brings Ethereum closer to the vision of account abstraction, offering simpler and more secure experiences for everyday users.

2. EIP-7251: Increased Staking Limit per Validator

Previously, each Ethereum validator could stake up to 32 ETH. With Pectra, the new limit is raised to 2,048 ETH per validator.

This change offers several benefits:

- Fewer validators required

- Reduced technical overhead on the network

- Improved efficiency for institutional staking solutions

3. Double the Blob Space: Boosting Layer 2 Scalability

Pectra doubles the available space for data blobs — a critical feature for rollups like Optimism, Arbitrum, and Linea.

In practice, this leads to:

- Faster transactions

- Lower fees

- Improved integration with Layer 2 solutions

Impact of Pectra on Ethereum’s Price

The activation of Pectra had an immediate impact on the market. ETH surged by approximately 28.9%, reaching around $2,400 just days after the upgrade. This upward movement reflects investor confidence in Ethereum’s long-term improvements and technical roadmap.

Bitcoin Surpasses Google and Amazon in Market Valuation

Source: companiesmarketcap

On May 9, 2025, Bitcoin reached a major milestone by overtaking Amazon in market capitalization, becoming the fifth most valuable asset in the world.

With BTC trading around $103,000, its market cap hit $2.045 trillion — slightly above Amazon’s $2.039 trillion. As of now, Bitcoin’s valuation stands at $2.048 trillion, while Amazon trails closely behind at $2.044 trillion.

Over the past six months, Bitcoin has shown remarkable growth, surpassing major assets like silver and Google (Alphabet). It overtook silver in November 2024 and briefly surpassed Google in April 2025, solidifying its position ahead of Amazon this month.

Fueled by growing institutional adoption and sustained investor interest, Bitcoin is increasingly positioned to climb even higher in the global asset rankings.

Kyrgyzstan Plans National Crypto Reserve with Support from Binance Co-Founder CZ

Fonte: X

Kyrgyzstan is making significant strides toward integrating cryptocurrency into its national economy.

On May 5, Binance co-founder Changpeng Zhao (CZ) announced via X that he had advised the Kyrgyz government to create a national reserve backed by Bitcoin (BTC) and BNB, Binance’s native token.

Recently appointed as an advisor to the country’s National Investment Agency (NIA) for blockchain and crypto-related initiatives, CZ is already influencing strategic decisions in the region.

Key Developments

- Binance Agreement with Kyrgyz Authorities

On May 4, Binance signed a memorandum of understanding (MoU) with the NIA to introduce crypto payment solutions and promote blockchain education. - Introduction of Binance Pay

As part of the partnership, Binance Pay will be rolled out in Kyrgyzstan, allowing both residents and visitors to make everyday transactions using cryptocurrencies. - Blockchain Education Programs

Binance Academy will collaborate with government agencies and local financial institutions to develop blockchain-focused educational initiatives. - Plans for a Gold-Backed Stablecoin (USDKG)

The Kyrgyz government is also exploring the launch of a national digital currency named USDKG. Pegged to the U.S. dollar and backed by $500 million in gold reserves from the Ministry of Finance, this stablecoin aims to bring more security and stability to digital currency users in the country.

These efforts underline Kyrgyzstan’s ambition to become a crypto-friendly nation, attracting investment, modernizing its economy, and expanding access to innovative financial tools.

The direct involvement of CZ and Binance adds credibility to the initiative and could position Kyrgyzstan as a model for other developing nations seeking to embrace digital assets.

New Hampshire Becomes First U.S. State to Approve Bitcoin Reserve Law

Source: CryptoNinjas

New Hampshire has taken the lead in the Bitcoin race, becoming the first U.S. state to establish a Bitcoin reserve.

On May 6, 2025, Governor Kelly Ayotte signed HB 302 into law, authorizing the state treasurer to allocate up to 5% of public funds into Bitcoin or other assets with a market capitalization exceeding $500 billion — making Bitcoin the only currently eligible asset.

According to State Representative Keith Ammon, the bill’s author, the goal is to diversify the state’s reserves and protect purchasing power against inflation, particularly in response to the federal government’s ongoing monetary expansion.

While states like Arizona and Florida have attempted similar initiatives — unsuccessfully so far — New Hampshire is now leading the way with a strategic reserve backed by Bitcoin.

This move could inspire other state governments to adopt similar policies, especially amid growing global skepticism toward fiat currencies.

It represents a major step in integrating digital assets into public finance frameworks.