The Glorious Days of Crypto

Do you remember the glorious days of the crypto space when Bitcoin was hitting $68,000, and the world was abuzz with speculation about reaching the elusive 1M mark? Altcoins like KLV saw an all-time high of $0.16. A whirlwind of excitement, predictions, and hope filled the air. But as the market shifted, those old predictions turned into lingering questions, leaving many to wonder, Will crypto go back up?

Let’s answer that question in this article.

A New Dawn for Crypto

The cryptocurrency market began the new semester with a surge, and BTC’s price soared above $30,000. However, the enthusiasm of crypto fans was not enough to sustain the price above the 28k support line. The number one crypto faced a decrease of 17.92%, currently trading at $26,080.82. Factors such as the Ukraine and Russia war, the Federal Reserve’s interest rate hike, SEC’s crypto scrutiny, SpaceX’s BTC liquidation, and macroeconomic pressures have contributed to this decline.

Section 1: Current Market Overview

The global crypto market cap is $1.04T, a 0.49% decrease over the last day. The total crypto market volume over the last 24 hours is $24.46B, a 12.56% decrease. The total volume in DeFi is currently $1.93B, 7.90% of the total crypto market 24-hour volume. The volume of all stable coins is now $23.36B, 95.49% of the total crypto market 24-hour volume. Bitcoin’s dominance is currently 48.35%, an increase of 0.06% over the day.

The Broader Sentiment of the Crypto Market

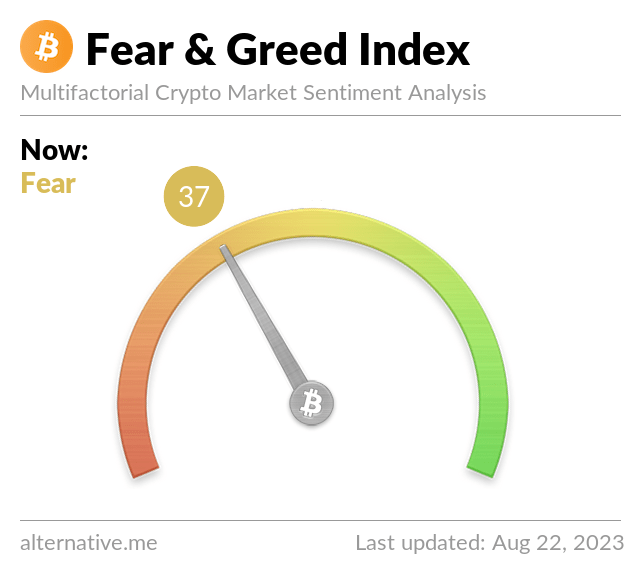

$BTC Fear and Greed Index. Source: @BitcoinFear

The broader sentiment of the crypto market has taken a turn from ‘neutral’ to ‘fear,’ falling to 37 points, according to the Bitcoin Fear and Greed Index page. Bitcoin’s price has been currently fluctuating around $26,800, having briefly dipped to the $25,500 mark on Friday, August 18, 2023. This movement coincides with the filing of Chapter 15 U.S. bankruptcy protection by China’s Evergrande conglomerate, a significant step in one of the largest debt restructurings globally. Concerns are escalating about China’s deepening property crisis and the ripple effects it may have on an already fragile economy, casting a shadow over the cryptocurrency market.

Ether ($ETH) recently experienced a momentary dip into the $1500 trading zone but quickly regained confidence. As of the writing of this article, prices are hovering above $1600, reflecting the cryptocurrency’s resilience and the market’s underlying strength.

The Federal Open Market Committee (FOMC) kept the federal funds rate effective at 5.33% as of August 17, 2023. This decision reflects the current economic stance and has shaken user sentiments, adding to the complexity of the cryptocurrency landscape and influencing market behavior.

Section 2: Crypto and Blockchain Adoption – A Compelling Case for Growth

Financial Sector

Traditional Banking and Blockchain: The financial world is increasingly recognizing the potential of blockchain for enhancing transparency, security, and efficiency. This technology is transforming everything from cross-border payments to fraud prevention.

JP Morgan’s JPM Coin: In a significant move, JP Morgan has utilized its JPM Coin for the first blockchain transaction for corporate clients in Europe. This innovation allows for 24/7 transfers between client accounts, showcasing a modern approach to banking.

Central Bank Digital Currencies (CBDCs): CBDCs are digital currencies issued by central banks, mirroring the value of a country’s traditional fiat currency. Unlike cryptocurrencies, which are decentralized, CBDCs are centrally controlled. They aim to offer benefits like privacy, convenience, and financial security while reducing costs associated with maintenance and cross-border transactions. As of early 2023, 11 nations have implemented CBDCs, and many others, including the U.S., are exploring this concept. CBDCs reflect a governmental response to the crypto movement, embracing some aspects of digital currency without fully committing to decentralization.

Government Adoption

The Rio de Janeiro government has taken a progressive step by accepting BTC as a payment method for public taxes. This is a significant endorsement of cryptocurrencies and showcases their practical application in governance.

Retail and Services Adoption

Rakuten, a global e-commerce giant, began accepting BTC payments in the U.S. in 2015 and later expanded worldwide, even creating their own blockchain wallet to receive crypto payments. Other examples include travel company Travala, Shopify, PayPal, Whole Foods, and AT&T. These adoptions signal a shift towards mainstream acceptance of cryptocurrencies.

Supply Chain Management

Companies like IBM and Walmart are leveraging blockchain to enhance supply chain transparency and traceability. This not only improves efficiency but also builds trust among consumers.

Blockchain in Healthcare

Blockchain technology is being used to secure and streamline the sharing of medical records among entities, ensuring privacy and integrity of data. This application of blockchain in healthcare is transforming the way patient information is managed and shared.

Decentralized Finance (DeFi)

The rise of DeFi platforms, which allow users to borrow, lend, or trade assets without traditional banks, is a testament to the innovation and potential of the crypto space.

NFTs and the Creative Economy

Non-fungible tokens (NFTs) have attracted numerous high-profile artists and celebrities, including Justin Bieber, Jay-Z, and Neymar, who have paid millions of dollars for digital images and collections. This trend has further driven interest in the crypto market.

Environmental Considerations

Moss is leading the way in reducing the carbon footprint of crypto, paving the way for carbon-neutral credits. Their commitment to sustainability is fostering innovations that could make the industry more environmentally friendly.

Regulatory Clarity

The regulatory environment for crypto has seen significant developments, such as Ripple winning a lawsuit against the SEC. This legal victory is seen as a landmark decision that could shape future regulations and foster growth and stability in the crypto space.

Section 3 – KleverCoin Scenario

KleverCoin ($KLV) reached an all-time high (ATH) of $0.16 in March 2021 when BTC was trading at $58,776. BTC’s price has a significant influence on altcoin prices, often moving in tandem with them. When BTC’s price rises, altcoins typically follow suit, and when it falls, they tend to decline as well. From 2021 until now, KLV’s price has suffered a significant loss of 98%, currently trading at $0.002372.

Will $KLV price go back up?

Since 2021, many improvements have been made to the Klever Ecosystem. To start, Klever launched its own blockchain named KleverChain, a user-friendly low-code platform designed for developers, where KLV, its native token, functions as fuel for the entire ecosystem.

A new Klever Wallet has been introduced to simplify user experience, acting as an entrance door to next-level blockchain technology. Features include Swap V2, which is faster and cheaper, a Klever Browser connecting users with the DApps experience (Kapps, for the Klevers), a Klever Extension for Desktop users, KleverSafe to secure $BTC, $ETH, $KLV, and over 10,000 tokens with offline safety, and an NFT marketplace enabling artists to create, deploy, and charge royalties for their creations, as well as buy, send, staking and maximize earnings with KDA tokens.

So, analyzing all the progress and nonstop building of the Klever team, $KLV prices have nowhere to go but up. Despite market volatility, when analyzing a project, crypto enthusiasts must consider the whole project itself, the coin’s usability, the development team, community engagement, and more. All these factors, along with macroeconomic considerations, contribute to an increase – or decrease – in crypto prices.

A Future Full of Potential

The crypto market is complex, influenced by a myriad of factors ranging from global economic conditions to individual project developments. While the current sentiment may be one of fear and uncertainty, the underlying trends show a promising future. The continuous growth and innovation in the crypto space, the adoption of blockchain technology across various sectors, and the relentless pursuit of excellence by projects like Klever are all indicators of a bright future. The question: Will crypto go back up? may still linger, but the evidence points to a resilient and evolving landscape that holds immense potential for those willing to navigate its complexities.

Experience the Future of Crypto with Klever Wallet

.png)

Ready to take your crypto experience to the next level? Download the Klever Wallet today and immerse yourself in a world of seamless transactions, innovative features, and top-notch security. Whether you’re a seasoned crypto enthusiast or just starting your journey, Klever Wallet offers something for everyone. From swapping and staking to exploring the exciting world of NFTs, Klever puts the power of blockchain at your fingertips. Don’t miss out on the future of finance. Download Klever Wallet now and unlock the full potential of crypto!

Delve into the complex world of crypto winters, understanding their causes, impacts, and survival strategies. Discover why Klever Wallet is a vital tool for anyone engaged in the volatile cryptocurrency market.

Facing a turbulent market, many are asking, ‘Will crypto go back up?’ This in-depth analysis explores the current landscape, from Bitcoin’s fluctuations to the rise of blockchain in various sectors, including healthcare and finance. Discover how innovations like KleverCoin are shaping the future, and learn why the crypto space may be poised for a resurgence. Dive into the trends, technologies, and triumphs that could signal a bright future for cryptocurrencies.

Explore the multifaceted reasons behind the recent crypto market crash. From the Evergrande crisis to SpaceX’s financial decisions, the Federal Reserve’s report, and market sentiment, this comprehensive analysis uncovers why crypto is down and poses the question: will crypto recover?

.png)

.png)