Hey crypto fans.

The upcoming Bitcoin halving event, anticipated to occur in just 33 days, marks a pivotal event in the cryptocurrency sphere, embodying a momentous milestone for Bitcoin (BTC) enthusiasts and investors alike. This event, set to reduce the reward for mining a new block by half, from 6.25 bitcoins to approximately 3.125 bitcoins, is a fundamental mechanism designed to control Bitcoin’s supply and mimic the scarcity attributes of precious metals.

As the halving approaches, the crypto community is abuzz with speculation and anticipation, pondering the potential impacts on Bitcoin’s price and the broader cryptocurrency market.

Historically, halving events have led to significant price fluctuations and increased market activity, driven by a combination of reduced new supply, speculative interest, and heightened media attention. As such, this upcoming halving is not just a technical adjustment but a moment that could influence Bitcoin’s economic model, investor sentiment, and the cryptocurrency landscape at large. Let’s discover more.

What is Bitcoin Halving?

A halving in Bitcoin is a crucial event in the Bitcoin blockchain that happens approximately every four years, or more precisely, every 210,000 blocks. It involves reducing the reward that miners receive for adding new blocks to the blockchain by half.

This mechanism is embedded in Bitcoin’s code and serves several key purposes, such as:

Control Inflation: Halving decreases the rate at which new bitcoins are created, effectively controlling inflation and mimicking the extraction of precious metals like gold. This deflationary mechanism is designed to ensure that Bitcoin does not suffer from high inflation rates that can diminish its value over time.

Supply Distribution: By reducing the reward for mining, halving extends the period over which new bitcoins are created. This gradual distribution ensures that the total supply cap of 21 million bitcoins will not be reached too quickly. It is estimated that the last bitcoin will be mined around the year 2140.

Price Impact: Historically, halvings have led to increased interest and speculative activity around Bitcoin, often resulting in significant price movements. This is partly because the reduced supply of new bitcoins entering the market can lead to an imbalance between supply and demand, especially if demand remains strong or increases.

Network Security: Mining rewards are crucial for the security of the Bitcoin blockchain, as they incentivize miners to contribute their computational power to validate transactions and secure the blockchain. Halvings ensure that this reward continues over a longer period, maintaining network security while gradually transitioning to transaction fees as a more significant part of miners’ rewards as the block reward diminishes.

Bitcoin halving is seen as a significant event within the cryptocurrency community due to its direct impact on miners’ profitability, its indirect effects on the Bitcoin market, and its role in the long-term sustainability and security of Bitcoin as a decentralized digital currency.

When was the last bitcoin halving?

The last Bitcoin halving occurred on May 11, 2020. This event marked the third halving in the history of Bitcoin, reducing the reward for mining a block from 12.5 bitcoins to 6.25 bitcoins.

Previous bitcoin halvings

The previous Bitcoin halvings before the 2020 event occurred on the following dates:

First Halving: November 28, 2012 – The reward for mining a block was reduced from 50 bitcoins to 25 bitcoins.

Second Halving: July 9, 2016 – The reward for mining a block was reduced from 25 bitcoins to 12.5 bitcoins.

Why is bitcoin halving increasing the price of cryptocurrencies?

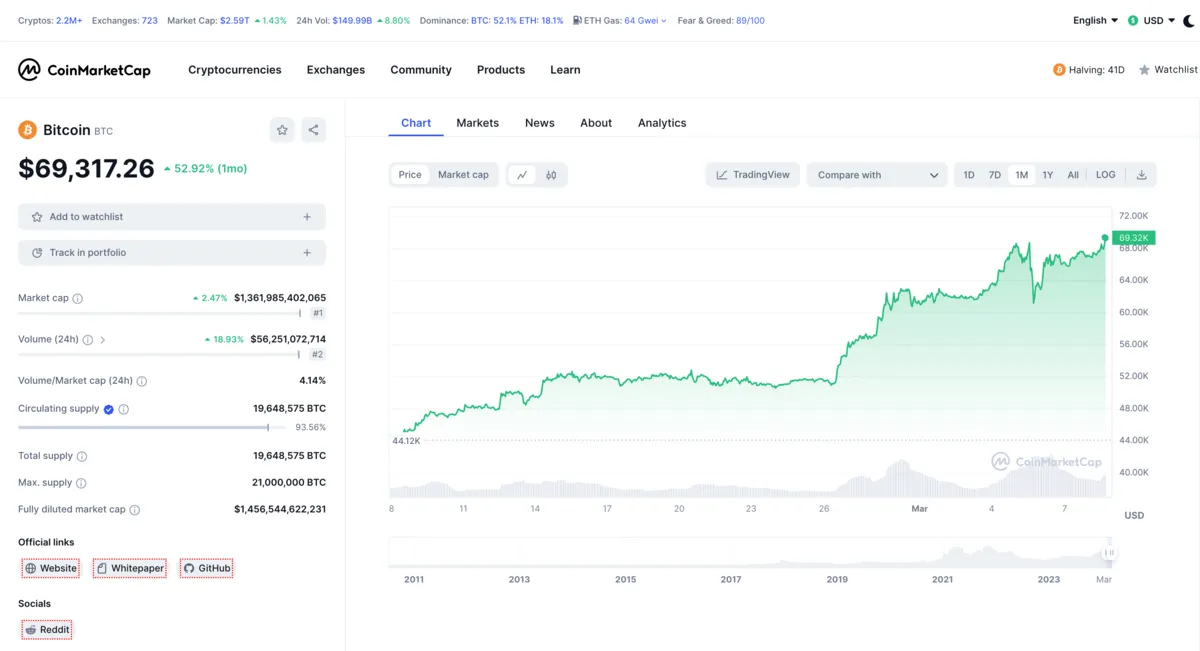

Source: Coin Market Cap

Bitcoin halving tends to impact the price of cryptocurrencies, including Bitcoin itself, for several reasons tied to fundamental economic principles of supply and demand, investor expectations, and speculative behavior:

Reduced Supply

The primary effect of a halving is the reduction in the rate at which new bitcoins are created. This effectively limits the new supply of Bitcoin, making it scarcer. If demand remains constant or increases, the reduced supply can lead to an increase in Bitcoin’s price.

Anticipation and Speculation

Leading up to a halving event, there is often increased media attention and speculation regarding its potential impact on Bitcoin’s price. This can lead to increased buying activity as investors anticipate future price increases, driving up the price in the short term.

Miner’s Selling Pressure

Miners earn bitcoins as rewards for processing transactions and securing the Bitcoin network. After a halving, the reward for mining new blocks is halved, potentially reducing the incentive for miners to sell their newly mined bitcoins immediately if the market price does not cover their operational costs. This reduction in selling pressure from miners can contribute to a decrease in the available supply on the market, further influencing the price upwards if demand stays the same or increases.

Historical Precedent

The historical pattern has shown that Bitcoin’s price tends to increase following a halving. This pattern has led to the belief among some investors and traders that halvings are bullish events for Bitcoin’s price. As a result, investor sentiment and behavior around these events can become self-fulfilling prophecies, driving up the price due to increased buying in anticipation of higher prices in the future.

Klever Insight: Bitcoin price surges even more with the market pressure and hits all-time-high for the second consecutive time in a week, reaching $70,083.05 on this Mar 8, 2024.

Source: CoinBase

Long-Term Confidence

Bitcoin halvings reinforce the scarcity and deflationary nature of Bitcoin, underlining its contrast with fiat currencies, which can be printed in unlimited quantities by governments. This fundamental aspect of Bitcoin’s design can increase confidence in its long-term value proposition, attracting more long-term investors.

It’s important to note that while btc halvings have been associated with price increases in the past, the cryptocurrency market is influenced by a wide range of factors, including regulatory changes, technological advancements, and broader economic trends. Therefore, while bitcoin halving events are significant, they are just one of many factors that can impact the price of Bitcoin and other cryptocurrencies.

As the countdown to the Bitcoin halving ticks down, with only 41 days to go, the significance of this event in the cryptocurrency landscape cannot be overstated. This halving is a crucial moment that could impact Bitcoin’s valuation and the broader market dynamics. In light of this, it’s an opportune time to consider engaging with Bitcoin. For those looking to buy and secure Bitcoin, opting for a reliable platform is key. Klever emerges as a commendable choice, offering a secure wallet for your Bitcoin transactions. Its emphasis on security ensures your digital assets are safeguarded, providing peace of mind in the volatile realm of cryptocurrency. Explore the possibilities with Klever and make a strategic move by securing your Bitcoin ahead of the halving event.