June hasn’t even started properly — and it’s already a mess.

In just the first week, we’ve seen a public feud between Donald Trump and Elon Musk escalate into market chaos, wiping billions off Tesla’s value and shaking investor confidence. But that was only the beginning.

Bitcoin plunged, Ethereum gained ground, and a memecoin mocking Trump’s proposed bill exploded 73% in a day. While crypto was reacting to political noise, Wall Street was celebrating: Circle’s IPO soared 168% on its NYSE debut, marking a major milestone for regulated stablecoins.

BlackRock made a bold move too, snapping up over $34 million in ETH for its Ethereum ETF — just as Bitcoin funds faced major outflows.

And in DeFi, a surprise name emerged: Hyperliquid not only topped the blockchain profit charts in May but also made headlines after one trader lost $25 million in a single trade.

From political power plays to crypto market volatility and record-breaking stock moves, the first week of June has already delivered more drama than most months.

Here’s a full breakdown of what happened — and why it matters.

Trump vs Elon Musk: What’s Behind the Feud That Shook Tesla and the U.S. Political Landscape

Source: BBC

On June 5, 2025, the world witnessed a public clash between two of the most influential figures in the United States: Donald Trump and Elon Musk.

But after all, what sparked this feud? And what are the consequences for the market, politics, and Musk’s future?

The trigger was the bill introduced by Trump, called the One Big Beautiful Bill Act. Musk openly criticized the proposal, claiming that it:

- Would increase the public deficit

- Would eliminate tax incentives for electric vehicles

This would directly affect the businesses of Tesla and SpaceX.

Elon Musk, who had previously supported Trump financially, responded with harsh criticism. He stated that the plan not only harms the clean energy sector but could also increase the public deficit by trillions of dollars.

Trump, in turn, publicly responded by accusing Musk of suffering from “Trump syndrome” and threatened to cut all federal contracts with companies linked to him, including SpaceX. He claimed that the billionaire was acting out of self-interest.

The crisis between Trump and Musk intensified when the two took the conflict to social media, specifically on X (formerly Twitter).

The U.S. president posted a series of posts attacking Musk, calling him “crazy” and suggesting that the billionaire was acting like a traitor after years of support and benefits granted by the government.

Musk did not remain silent. He hit back by calling Trump “ungrateful” and hinted that the president might be involved in more serious scandals, such as the Epstein case — although he presented no evidence.

What began as a political disagreement quickly turned into a personal dispute with direct impact on the markets and public debate.

The feud had a direct impact on the financial market. Tesla shares fell 14% in a single day, resulting in:

- A loss of approximately $152 billion in market value

- Uncertainty among investors about the stability of Musk’s empire

- Doubts about the future of public contracts involving SpaceX

Another point that drew attention was Musk’s political response: he mentioned the possible creation of a new centrist party — which could represent a break from the support he previously gave to Trump.

The dispute between Trump and Elon Musk is not just a clash of egos. It represents a confrontation between two visions for the country: one focused on populism and economic nationalism, the other centered on technology, innovation, and new business models.

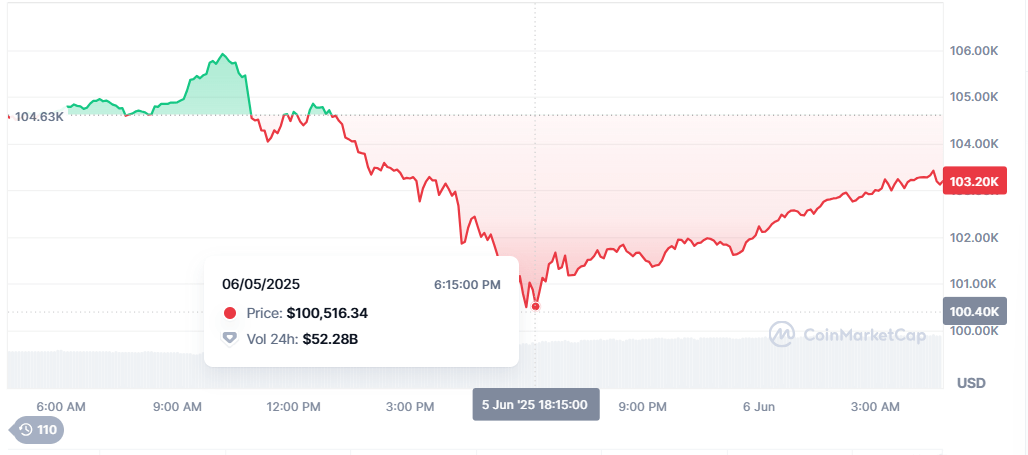

Bitcoin Falls After Clash Between Trump and Elon Musk

Source: CoinMarketCap

Following the public dispute between Trump and Musk on Thursday (June 5), Bitcoin faced a sharp sell-off — dropping from $105,800 to $100,700 within a few hours. Although the cryptocurrency recovered part of its value, it still ended the day with significant losses.

The steep decline in Bitcoin led to:

- Increased caution among institutional investors

- Capital reallocation to stablecoins like USDT and USDC

- A renewed argument that, despite being seen as a store of value, BTC remains highly sensitive to political and macroeconomic shocks

This recent drop wasn’t driven solely by technical analysis or isolated selling pressure. It was a direct reflection of a scenario where risky fiscal policy, power struggles between influential figures, and leveraged markets collide.

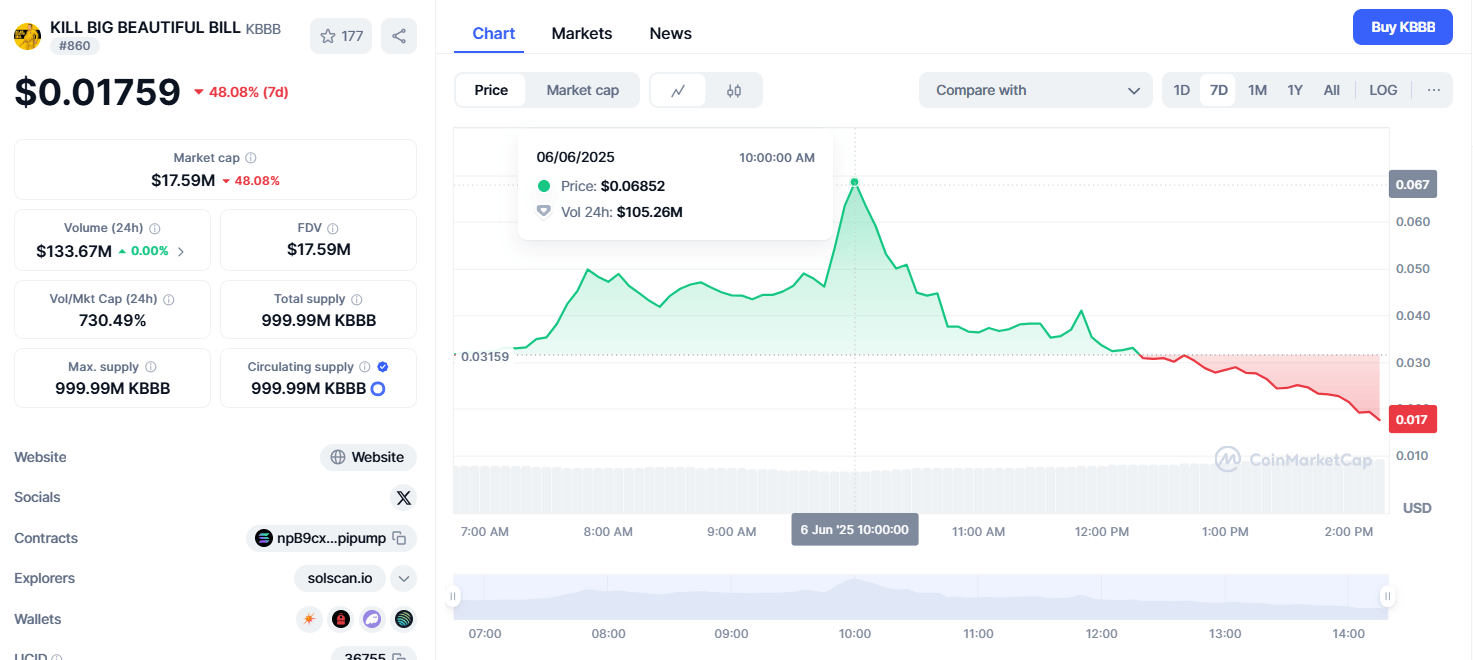

Memecoin Inspired by Trump–Musk Feud Surges 73% in 24 Hours

Source: Coinmarketcap

The public battle between Donald Trump and Elon Musk has taken a new turn — this time in the crypto world.

A new memecoin called Kill Big Beautiful Bill (KBBB) was launched amid Musk’s criticism of Trump’s fiscal proposal and made an explosive market debut, jumping 73% in its first 24 hours.

KBBB emerged as a satirical response from the crypto community to Trump’s bill, informally called the One Big Beautiful Bill.

Elon Musk strongly criticized the proposal, saying it undermined previous efforts to streamline government spending. He posted an image from the film Kill Bill on X (formerly Twitter), referencing the bill’s name — a post that fueled the coin’s creation.

The memecoin was launched on Pump.fun, a platform known for quickly spinning up viral and politically themed tokens in minutes.

Rapid Surge and Community Hype

In the first 9 hours after launch:

- The token peaked at $53 million in market cap

- It traded as high as $0.037

- Despite a pullback, it still holds a 73% daily gain

The community also used AI to generate artwork of Elon Musk as Kill Bill, boosting the project’s viral appeal.

One investor reportedly turned $4,599 into $59,700, according to data from Pump.fun.

Why Is the Crypto Market Falling?

Source: BeInCrypto

This Friday, June 6, 2025, the cryptocurrency market faced another correction, with a 2.3% drop in total value, now hovering around $3.21 trillion.

But what’s behind this negative move? The day was marked by a combination of technical and political factors that together triggered strong selling pressure.

1. Trump–Elon Musk Feud Shakes Market Sentiment

The main trigger for instability was the public feud between Donald Trump and Elon Musk.

After Musk criticized Trump’s proposed fiscal bill — which could increase U.S. debt by trillions — the president responded by threatening to cut federal contracts with Musk’s companies, such as Tesla and SpaceX.

This war of words increased political uncertainty and directly impacted investor confidence in risk assets like Bitcoin.

2. Mass Liquidations Accelerate the Drop

The decline was intensified by a wave of liquidations in crypto futures contracts. In the last 24 hours alone:

- Over $980 million in positions were liquidated

- Around $874 million of those were long positions (bets on price going up)

This sharp movement pushed prices even lower, triggering a cascade effect across the market.

3. Flash Crash: $262 Million Liquidated in One Hour

The most intense moment of this correction came in the afternoon of June 5, when the market witnessed more than $262 million in liquidations in just one hour.

This massive volume of long-position losses highlights how rapid price swings — even if brief — can cause large-scale capital destruction.

Such liquidations often occur when traders use high leverage without protection, like stop-loss orders.

A sudden price drop triggers margin calls, closing contracts automatically — amplifying the downtrend and creating a cycle of panic and forced selling.

4. Technical Analysis Reveals Structural Weakness

Aside from external triggers, analysts pointed to a technical breakdown as well.

Bitcoin broke below a descending parallel channel, reinforcing signals of technical weakness.

The next major support is around $97,500, and if that level breaks, volatility could increase even further.

Today’s drop underscores how the crypto market remains highly sensitive to political shocks and technical signals.

The combination of a political conflict, aggressive liquidations, and a fragile chart structure affected all major cryptocurrencies — including Bitcoin, Ethereum, XRP, and Solana.

Circle Stock Soars 168% on New York Stock Exchange Debut

Source: Cointimes

Circle Internet Financial — the company behind the USDC stablecoin — made its debut on the New York Stock Exchange (NYSE) this Thursday (June 5), with an impressive 168% surge on its first day of trading.

Traded under the ticker CRCL, the company raised $1.1 billion in its initial public offering (IPO), making it one of the largest crypto-related listings to date.

A Milestone for Crypto in Traditional Finance

Circle’s IPO marks a major milestone for the crypto sector, signaling the growing integration of blockchain companies into traditional financial markets.

The success of Circle’s debut underscores the rising interest from institutional investors in digital assets and regulated stablecoins.

USDC is currently one of the most widely used stablecoins in the global market. Circle’s strong stock performance may:

- Attract new institutional players

- Boost the credibility of the stablecoin market

- Encourage other crypto companies to go public — as Coinbase and Robinhood have already done

Circle IPO Highlights

Circle raised around $1.1 billion by selling 34 million shares at an initial price of $31 per share — above the expected range of $27 to $28.

On its opening day:

- Shares opened at $69

- Hit an intraday high of $103.75

- Closed at $83.23

This represents a 168% gain from the IPO price.

It’s worth noting that Circle previously attempted to go public via SPAC in 2022, but the deal fell through. Now, with a more favorable regulatory environment in the U.S., the company has finally secured its spot on the NYSE.

This outcome strengthens the argument that crypto companies — especially those offering stable and regulated solutions like USDC — are gaining ground in traditional finance.

BlackRock’s Ethereum ETF Buys Millions in ETH in a Single Day

Source: Reddit

On June 5, 2025, BlackRock’s spot Ethereum ETF — the iShares Ethereum Trust (ETHA) — made waves in the market by purchasing 13,310 ETH, worth approximately $34.7 million.

This was the largest single-day purchase among all U.S.-listed Ethereum ETFs on that day, highlighting the growing institutional appetite for crypto assets.

The transaction was recorded in the fund’s public filings and shows an aggressive positioning by BlackRock — especially when compared to the negative flows seen in other ETFs, such as Fidelity’s. Overall, the Ethereum ETF market posted a net positive inflow of $11.3 million, largely driven by ETHA.

What Is the iShares Ethereum Trust (ETHA)?

ETHA is BlackRock’s spot Ethereum ETF, launched following the SEC’s approval of spot ETH ETFs in May 2025.

Traditional investors are gaining direct exposure to Ethereum (ETH) without needing to manage digital wallets, crypto exchanges, or custodians.

This structure has become increasingly popular among institutional investors and funds looking to diversify into digital assets in a regulated and secure way.

Market Impact and Expectations

This major purchase reinforces the ongoing institutionalization of Ethereum, a trend that has accelerated since the green light for spot ETFs.

The entry of heavyweight players like BlackRock is seen as a strong signal of long-term confidence in ETH, which may:

- Increase demand for ETH

- Support its price during market corrections

- Boost the chances of new regulated crypto-based financial products

Experts also suggest that moves like this could help solidify Ethereum’s role as a core asset in the future of tokenized finance.

Bitcoin Drops, Ethereum Rises: ETF Flows Reveal Capital Rotation

Source: Contribune

June 5, 2025, marked a significant institutional rotation in the crypto market.

Flow data reveals that Bitcoin ETFs saw net outflows of $278.4 million, while Ethereum ETFs recorded net inflows of $11.3 million.

The sharp contrast between the two assets highlights a notable shift in institutional investor behavior.

Bitcoin ETFs Face Heavy Outflows

According to consolidated data, approximately 2,660 BTC were sold through ETFs on that day. The biggest losers included:

- Fidelity Wise Origin Bitcoin Fund (FBTC): $134 million in outflows

- iShares Bitcoin Trust (IBIT) by BlackRock: $89.2 million withdrawn

These outflows may have been triggered by profit-taking, risk aversion amid macroeconomic uncertainty, or simply portfolio rebalancing. The selling pressure also coincided with a modest price correction in Bitcoin.

Ethereum ETFs See Institutional Buying

While Bitcoin experienced redemptions, Ethereum posted a net inflow of 4,340 ETH (around $11.3 million).

The standout was BlackRock’s iShares Ethereum Trust (ETHA), which alone purchased 13,310 ETH, valued at $34.7 million.

This strong institutional buying comes just days after the official approval of spot Ethereum ETFs in the U.S. — a regulatory milestone that is unlocking new institutional capital into ETH.

Capital Rotation in Motion

The divergence in ETF flows between Bitcoin and Ethereum may signal a temporary shift in institutional preference between the two largest cryptocurrencies.

While Bitcoin sees capital moving out, Ethereum appears to be gaining trust, likely driven by its emerging institutional narrative — especially following the regulatory breakthrough for ETH-based financial products.

Hyperliquid Surpasses Ethereum, TRON, and Solana in Gross Profit in May 2025

Source: Binance

Hyperliquid, a DeFi platform specializing in perpetual contracts, led the gross profit ranking among blockchains in May 2025, outperforming major players like TRON, Ethereum, Base, and Solana.

With $72.3 million in gross profit, Hyperliquid stood out as the most profitable blockchain of the month, solidifying its position as a rising force in the decentralized finance ecosystem.

Hyperliquid Surpasses Ethereum, TRON, and Solana in Gross Profit in May 2025

Source: CryptoRank.io

Hyperliquid, a DeFi platform specializing in perpetual contracts, led the gross profit ranking among blockchains in May 2025, outperforming giants like TRON, Ethereum, Base, and Solana.

With a result of $72.3 million in profit, Hyperliquid stood out as the most profitable blockchain of the month, consolidating its position as an emerging powerhouse in the decentralized finance ecosystem.

Gross Profit in May 2025: Hyperliquid at the Top

According to data from CryptoRank, the profits of the top blockchains were as follows:

- Hyperliquid: $72.3 million

- TRON: $58.3 million

- Ethereum: $21.8 million

- Base: $5.8 million

- Solana: $4.7 million

Hyperliquid’s performance is even more impressive considering its recent rise and the fact that it surpassed much more established networks.

What Is Hyperliquid?

Hyperliquid is a decentralized exchange (DEX) focused on perpetual contracts with leverage up to 75x and a 100% on-chain order book.

Its innovative model — featuring competitive fees and efficient execution — has attracted a growing number of institutional and retail traders.

Even after suffering a $13.5 million exploit in March, Hyperliquid recovered quickly.

One decisive factor was the trust of major traders, such as James Wynn, who moved over $100 million on the platform in recent operations.

HYPE Token Rallies: 61% Growth in May

The native token HYPE also benefited from the strong momentum. In May 2025:

- The token appreciated 61%

- The fee-based buyback model boosted demand

- Hyperliquid distributed liquidity incentives directly to users

This revenue-sharing mechanism attracted even more investors and helped consolidate the project’s ecosystem.

Record Profits and Sustainable Growth

Beyond record-breaking profits, Hyperliquid also reported:

- A 156% increase in TVL (Total Value Locked), reaching $418 million

- An annual yield (APY) of 13.7% for liquidity providers — competing with major DeFi platforms

These figures reinforce the idea that Hyperliquid is not only profitable but also sustainable and appealing to long-term users.

Trader James Wynn Loses $25 Million in Leveraged Bitcoin Position on Hyperliquid

Source: Cointelegraph

Crypto trader James Wynn has returned to the spotlight after suffering a $25 million loss in a highly leveraged Bitcoin (BTC) trade on the Hyperliquid platform.

The episode raises concerns about the risks of extreme leverage in the crypto market — especially on platforms where user positions are made public.

Wynn held a 240 BTC position leveraged at 40x on Hyperliquid, betting on a rise in Bitcoin’s price.

Even after reducing part of his exposure, the decline in BTC’s price triggered an automatic liquidation, resulting in an estimated $25 million loss.

This wasn’t his first major setback. In May 2025, Wynn had already suffered a $100 million loss when Bitcoin dropped below $105,000.

Despite the recent liquidation, he still holds around 770 BTC, worth approximately $80.5 million, with a projected liquidation price of $104,035.

According to Hypurrscan, he currently faces an unrealized loss of $1 million.

On social media, Wynn claimed he was the target of market manipulation, even going so far as to request crypto donations to “expose those responsible.”

Hyperliquid’s Role and Position Transparency

Hyperliquid, a decentralized exchange (DEX) focused on perpetual contracts, allows the positions of top traders to be public — a feature that can enable front-running or forced liquidation strategies by other market players.

While this level of transparency adds openness to the ecosystem, it can also make large traders like Wynn easy targets for coordinated market attacks.

A $25M Loss That Sparks Broader Debate

James Wynn’s $25 million loss on Hyperliquid reinforces the dangers of high leverage in the crypto space — particularly in fully transparent trading environments.

The case reignites discussions around:

- Market safety

- Manipulation risks

- And the need for structural innovation in decentralized exchange design

It’s a stark reminder of how visible, over-leveraged positions can turn into massive losses in highly competitive markets.