The week kicked off at full speed — and only gained more momentum.

Amid military strikes, major economic announcements, unexpected regulatory support, and record-breaking performances by big companies, the crypto market was put to the test.

Bitcoin plunged following renewed tensions in the Middle East. Ethereum surged on positive signals from the SEC. Trump confirmed a trade agreement with China, reigniting debates over tariffs and global supply chains. And despite all the turbulence, crypto ETFs and billion-dollar institutional purchases continue to show strength.

All of this unfolded in less than a week.

The market is reacting in real time to political, military, and financial decisions that directly shape the present and future of digital assets. And those who are paying attention know: these are the moments that redefine trends — and uncover opportunities.

Trump Confirms Trade Agreement with China

Former U.S. President Donald Trump announced that a new trade agreement with China is “completely finalized,” with only the formal approval of Chinese President Xi Jinping pending.

The confirmation came from both U.S. and Chinese officials, marking a new phase in the trade relationship between the two countries after years of tariff disputes.

Key Points of the U.S.-China Agreement

- Tariffs Set:

- The U.S. will maintain a 55% tariff on Chinese products, broken down as follows:

• 10% base rate

• 20% on products containing fentanyl

• 25% inherited from the previous administration - China will impose a 10% tariff on U.S. goods.

- Rare Earth Supplies:

China has agreed to accelerate the export of rare earth magnets and minerals, which are critical for industries like electronics, energy, defense, and electric vehicles.

- Academic Access:

The U.S. will ease entry for Chinese students into American universities, promoting educational exchange between the two powers.

Why This Deal Matters to the Global Market

- Avoids escalation of the trade war: Prevents tariffs from rising to extreme levels (above 125%) on both sides.

- Unblocks production chains: Rare earths are essential for manufacturing chips, batteries, and EVs.

- Promotes political and economic stability: Shows diplomatic cooperation amid global uncertainty.

- Affects strategic sectors: Technology, energy, education, and global trade will all feel the impact.

Trump Praises China Deal but Defends Car and Steel Tariffs

In a recent speech, Donald Trump praised the trade agreement with China, calling it “great for both countries.”

He noted that China was open to cooperation, especially in allowing more U.S. goods into the Asian market.

However, Trump emphasized that:

- Tariffs on imported cars will remain high and are likely to increase further soon,

as part of a broader effort to protect the U.S. auto industry, which he sees as strategically vital.

He also reiterated the need to maintain high tariffs on imported steel and aluminum, stating this helps:

- Strengthen domestic production

- Expand national industrial capacity

- Maintain partial state control over U.S. Steel via a golden share

The U.S.-China agreement signals diplomatic progress, but without compromising internal economic protectionism.

Trump’s stance shows that, in his view, economic growth and industrial security must go hand in hand.

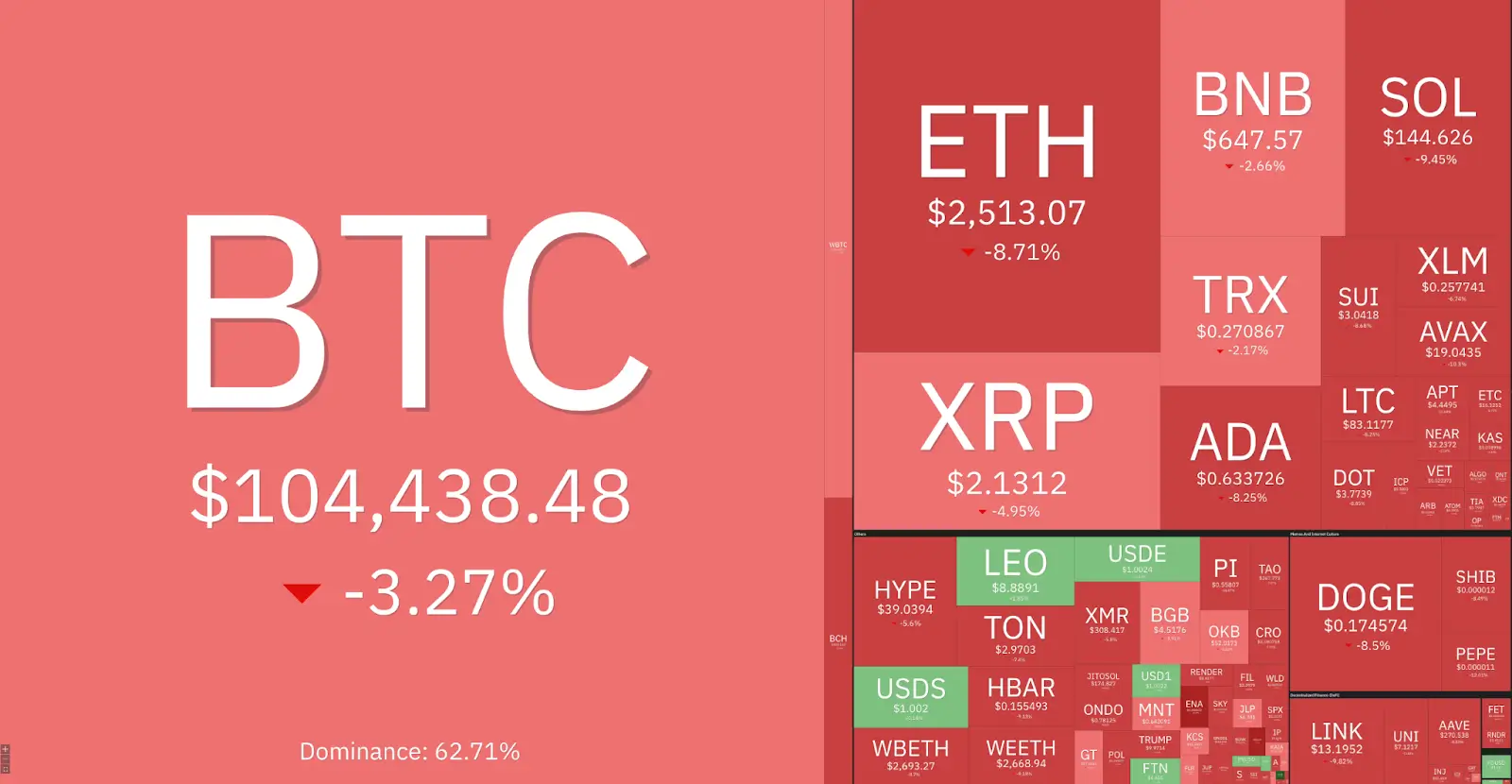

Crypto Market Drops 4% Amid Geopolitical Tensions

24-hour performance of large-cap cryptocurrencies. Source: Coin360

On June 13, the crypto market declined sharply, driven by geopolitical turmoil. A military strike by Israel on Iran triggered a global wave of risk aversion.

Investors sought safety in traditional assets like gold, oil, and U.S. Treasury bonds — moving away from crypto.

This flight to safety resulted in the largest liquidation volume since February:

- $1.15 billion in total liquidations in the past 24 hours

- $1 billion in long positions wiped out

- Bitcoin: $448 million liquidated

- Ethereum: $288 million liquidated

Performance of major cryptocurrencies. Source: CoinMarketCap

Despite the correction, technical analysts have identified the formation of a bull flag pattern, suggesting this pullback may be a temporary pause within an overall uptrend.

Key technical levels to watch:

- Support: $3.1 trillion (bottom of the current channel)

- Deeper correction target: $2.75 trillion (50-day moving average)

- Channel bottom: $2.31 trillion

If the $3.1 trillion support level holds, the bullish outlook remains intact.

Bitcoin Drops to $104K After Israel Strikes Iran

Bitcoin is trading at $104,370 at the time of publication. Source: CoinMarketCap

Bitcoin (BTC) saw a steep decline this Friday (June 13), falling to $104,700 (around R$584,000) following an Israeli airstrike on Iranian nuclear facilities, which led to the death of General Mohammad Bagheri.

The incident heightened geopolitical tensions in the Middle East and triggered a strong wave of risk aversion across global markets.

The escalation between Israel and Iran sparked a sell-off in risk assets, including cryptocurrencies and stocks.

In moments of uncertainty, investors tend to seek immediate liquidity — offloading even assets like Bitcoin, typically seen as a store of value, to reduce exposure.

André Franco, analyst at Boost Research, pointed out that during periods of extreme stress, not even BTC escapes selling pressure. The growing expectation of an Iranian counterattack increases the likelihood of a prolonged conflict, keeping markets on alert.

In addition to Bitcoin, other cryptocurrencies also declined:

- Ethereum (ETH) dropped approximately 7.2%, following broad-based crypto selling

- Brent crude oil rose about 8%, reflecting concerns over supply chain disruptions in the region

Even with falling prices, crypto-related ETFs continue to attract capital:

Bitcoin ETFs

- Net inflows (June 12): $86.3 million

- Highlight: BlackRock’s IBIT with +$288.3 million

Ethereum ETFs

- Net inflows (June 12): $112.3 million

- Highlight: BlackRock’s ETHA with +$101.5 million

Bitcoin’s drop to $104,000 shows the significant influence geopolitical tensions can have on the crypto market.

Even assets often viewed as safe long-term holdings, like BTC, are affected during times of heightened uncertainty.

Still, ETF data confirms that institutional demand remains strong, indicating that the long-term outlook for the crypto sector remains positive — even amid short-term turbulence.

SEC Reaffirms Right to Self-Custody and Repeals Anti-DeFi Proposals

Source: The Block

In June 2025, the U.S. Securities and Exchange Commission (SEC), now led by Paul Atkins, officially announced a shift in its regulatory stance that could reshape the future of digital assets in the country.

The SEC formally repealed rule proposals from the previous administration that aimed to impose restrictions on crypto self-custody and the operation of DeFi platforms.

According to Atkins, the right to self-custody is a core principle that must be preserved, emphasizing individuals’ direct control over their digital assets as part of financial freedom.

Key Changes Announced by the SEC

- Repeal of SAB 121

The controversial accounting bulletin SAB 121, which made it difficult for banks and brokers to hold digital assets on behalf of clients, was officially revoked. This opens the door for traditional financial institutions to act as crypto custodians with legal and regulatory clarity. - Withdrawal of Anti-DeFi Proposals

Proposals from the Gensler era that sought to classify DeFi protocols as registered securities exchanges were withdrawn. This move eliminates regulatory threats to developers and users of decentralized protocols. - Legal Recognition of Self-Custody

The SEC publicly acknowledged that U.S. citizens have the right to hold their digital assets independently, without being forced to rely on centralized custodians or intermediaries. - Commitment to Clear New Rules

Atkins stated that the SEC will focus on creating specific rules for the issuance, custody, and trading of crypto assets—moving away from the previous “regulation by enforcement” approach.

Immediate Impacts on the Crypto Market

For individual users:

- Legal protection for using self-custody wallets

- Reduced risk of penalties for holding crypto outside of centralized exchanges

- Greater confidence in self-custody solutions like Klever Wallet, Ledger, and Trezor

For institutional players:

- Banks can now offer crypto custody services with clear accounting standards

- Investment funds, family offices, and asset managers gain regulatory security in crypto operations

- Brokers with ATS systems can legally trade tokens like Bitcoin and Ethereum

The SEC’s new stance represents a significant regulatory pivot in the U.S.

By defending self-custody as a legitimate right, the agency takes a major step toward advancing individual digital sovereignty and unlocking innovation across the crypto industry.

Coinbase Launches Credit Card Offering Up to 4% Bitcoin Cashback

Source: Coinbase

On June 12, 2025, Coinbase announced the launch of the Coinbase One Card, a credit card offering up to 4% cashback in Bitcoin, developed in partnership with American Express.

The card will be exclusively available to Coinbase One subscribers and is set to launch in the U.S. in fall 2025.

How Does the Coinbase One Card Work?

- Earn 2% to 4% cashback in Bitcoin (BTC) on all purchases made with the card

- Cashback rate depends on the user’s crypto holdings on Coinbase

- The card will be automatically deactivated if the user cancels their Coinbase One subscription

- Includes AmEx benefits, such as travel insurance, purchase protection, and access to exclusive experiences

Only for Coinbase One Members

The card is only available to users subscribed to Coinbase One, which now offers two plans:

- Basic Plan: $4.99/month or $49.99/year

- Subscription perks include:

• Zero trading fees up to $500/month

• 4.5% APY on USDC (up to $10,000)

• Higher staking rewards

• Priority customer support and enhanced security tools

This initiative is part of Coinbase’s broader strategy to boost recurring revenue from subscriptions and reduce reliance on trading fees — especially during market downturns.

By offering Bitcoin cashback, the card acts as an incentive to keep funds on the platform and encourages everyday crypto usage.

Trump Voices Support for Bitcoin and Stablecoins at Coinbase Event

President Donald Trump made a video appearance at Coinbase’s “State of Crypto” conference.

During his remarks, he reaffirmed his commitment to the growth of cryptocurrencies in the U.S..

Trump expressed support for creating a favorable legal framework for blockchain technology and backed the GENIUS Act, a bill aimed at regulating dollar-backed stablecoins.

This move marks a clear shift from the previous administration, positioning the U.S. government as a potential global leader in crypto regulation — especially in an election year.

Strategy (formerly MicroStrategy) Buys Another $110 Million in Bitcoin, Reaches 582,000 BTC in Holdings

Source: TipRanks

Strategy, the company led by Michael Saylor (formerly known as MicroStrategy), has announced the purchase of 1,045 Bitcoins for $110.2 million. This marks the ninth consecutive week of acquisitions, further solidifying its position as the largest institutional holder of Bitcoin globally.

The company now holds a total of 582,000 BTC, valued at over $62 billion.

Michael Saylor, chairman of Strategy, continues to promote his thesis that Bitcoin is the most resilient asset of the 21st century. The firm follows an aggressive capital allocation policy, consistently acquiring large volumes of BTC.

Key Numbers

- Total invested to date: $40.79 billion

- Average purchase price per BTC: $70,086

- YTD return (2025): 17.1%

With 582,000 BTC in its treasury, Strategy now controls roughly 2.8% of all Bitcoin in circulation. This reinforces its self-described role as a “Bitcoin treasury company”, a term coined by Saylor to define the company’s new business model.

Market Valuation Exceeds Bitcoin Holdings

Strategy’s market capitalization has surged to $108 billion, nearly double the value of its Bitcoin reserves.

This gap has drawn criticism from analysts and investors — including well-known short seller Jim Chanos — who question the “premium” being priced into the company’s stock.

- Estimated BTC holdings: $62 billion

- Market cap: $108 billion

The firm’s continuous BTC purchases are heavily leveraged and involve sophisticated financial instruments. While this can magnify gains during bull markets, it also introduces significant downside risk if Bitcoin prices fall sharply.

What It Means for Investors

- Indirect Bitcoin exposure: Buying Strategy stock has become an alternative way to gain leveraged exposure to Bitcoin.

- High volatility: Since the company’s valuation depends heavily on BTC prices, its stock is highly volatile.

- Emerging trend: Companies like GameStop and Trump Media are reportedly exploring similar treasury models.

The latest 1,045 BTC acquisition reinforces Michael Saylor’s long-term conviction in Bitcoin.

With over half a million BTC on its balance sheet, Strategy remains the largest institutional holder of Bitcoin worldwide — but the scale of its exposure is also raising questions about risk management, valuation, and the sustainability of its strategy.

Ethereum and DeFi Tokens Surge After SEC Signals Support

Source: The Defiant

The price of Ethereum (ETH) and several major DeFi tokens spiked this week after the U.S. Securities and Exchange Commission (SEC) signaled openness toward decentralized projects.

Tokens like Uniswap (UNI) and Aave (AAVE) soared as much as 23%, following comments from the SEC Chair suggesting the possibility of a “regulatory exemption for innovation.”

What Drove the Rally?

The rally was fueled by recent statements from the SEC:

- The agency referenced potential regulatory adjustments that could favor decentralized finance (DeFi) projects

- SEC Chair mentioned the idea of a “regulatory exemption framework for on-chain innovation”

- The market interpreted this as a positive signal for legal clarity around tokens built on Ethereum

Top Gainers After the SEC’s Signal

- Uniswap (UNI): +23%, now trading at $8

- Aave (AAVE): +16%, currently at $305

- Sky (USDS): +15%, reaching $0.90

- Ethereum (ETH): +7%, trading at $2,743

Ethereum-based governance tokens also saw unusually high trading volumes.

Aave hit an all-time high of $26.2 billion in Total Value Locked (TVL) — a key indicator of DeFi activity.

Analysts noted that, in this instance, DeFi tokens led Ethereum’s rally, which is the reverse of the usual pattern where ETH typically moves first.

Why This Matters for Investors

- The SEC’s signal provides greater regulatory clarity for the DeFi sector

- Boosts confidence among developers, institutional investors, and crypto users

- The potential approval of the Clarity for Digital Tokens Act could legally solidify the operation of decentralized protocols

The SEC’s positive stance has triggered a new wave of momentum in the crypto market, especially for Ethereum-linked DeFi tokens.

The growing expectation of friendlier regulation reinforces the long-term potential of projects like Uniswap, Aave, and Sky, while also strengthening Ethereum’s position as the foundation of decentralized finance.

BlackRock’s Bitcoin ETF Breaks Record as Fastest Ever to Reach $70 Billion

Source: Coinpedia

BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has reached $70 billion in assets under management (AUM) in just 341 days, making it the fastest ETF in history to hit that milestone.

The previous record belonged to the gold ETF GLD, which took nearly five years (1,691 days) to reach the same level.

What Does This Mean for the Crypto Market?

1. Strong Institutional Demand for Bitcoin

The rapid growth of IBIT highlights the rising interest from institutional investors seeking secure, regulated exposure to Bitcoin — without the need to directly purchase or custody the asset themselves.

2. BlackRock Leads U.S. Bitcoin ETF Market

While IBIT now manages $70 billion, the second-largest U.S. Bitcoin ETF, offered by Fidelity, holds around $31 billion.

BlackRock’s dominance in the crypto ETF space is clear, reinforcing its leadership in the U.S. market.

3. IBIT Holds a Significant Share of Total Bitcoin Supply

As of April, IBIT held roughly 661,000 BTC, equivalent to around 2.8% of Bitcoin’s circulating supply.

This emphasizes the structural impact ETFs have on Bitcoin’s liquidity and price behavior.

4. Historic Milestone and New Market Benchmark

BlackRock’s ETF had already set a record in February 2024 by becoming the fastest ETF to reach $10 billion.

Now, hitting $70 billion in less than a year, IBIT sets a new benchmark for ETF success — surpassing even traditional giants like SPY, QQQ, and GLD.

The iShares Bitcoin Trust (IBIT) has made history by becoming the fastest ETF to ever reach $70 billion.

This milestone reinforces Bitcoin’s integration into traditional financial markets, expands institutional access, and strengthens the role of ETFs as a key gateway for crypto investment.

GameStop Increases Bitcoin Exposure — Market Reacts with Sharp Sell-Off

GameStop (GME) has announced an increase in its convertible notes offering from $1.75 billion to $2.25 billion, raising an additional $500 million in capital.

The company stated the funds will be used for general corporate purposes, including strengthening its Bitcoin investment strategy.

Following the announcement, GameStop shares plunged over 20%, reflecting investor concerns over rising debt levels and the inherent volatility of Bitcoin.

GameStop Has Already Invested Over $500 Million in Bitcoin

In a recent filing, GameStop confirmed the purchase of 4,710 BTC, currently valued at around $513 million, placing the company among the largest corporate Bitcoin holders globally.

The new capital raise is expected to further expand this position, signaling that GameStop is adopting a strategy similar to MicroStrategy, which has also financed crypto acquisitions through debt issuance.

Debt Offering Details

- Total issuance (post-expansion): $2.25 billion

- Maturity: June 2032

- Type: Senior convertible notes

- Use of proceeds: Working capital and investments — including digital assets like Bitcoin

- Additional option: An extra $337.5 million in notes may be issued, pushing the total to $2.68 billion

Why Did the Market Punish GameStop?

Despite the narrative of innovation, the strategy triggered skepticism for three main reasons:

- High crypto risk exposure:

Traditional investors still view Bitcoin as volatile and speculative — especially when adopted by non-financial companies. - Aggressive debt expansion:

The move to raise long-term debt raises questions about the company’s financial sustainability given ongoing operational challenges. - Shift from core business:

Investors fear the company is drifting away from its core gaming retail operations, adopting a profile more aligned with a crypto investment firm.

With this new issuance, GameStop is clearly signaling its intention to maintain and expand its presence in the crypto ecosystem.

The market’s strong negative response shows there’s still a gap between institutional Bitcoin enthusiasm and traditional investor risk perception.

While the strategy could pay off if Bitcoin continues to rise, it also introduces significant short-term risks — both for stock stability and shareholder confidence.

U.S. Crypto Regulation Bill Moves to House Floor for Vote

Source: Decrypt

The Digital Asset Market Structure Bill — also known as the CLARITY Act — has just been approved by two key U.S. House committees: the Agriculture Committee and the Financial Services Committee.

With this approval, the bill now advances to a full House floor vote, marking a major step toward establishing a clear regulatory framework for digital assets in the United States.

What Does the Bill Propose?

1. CFTC to Lead Crypto Regulation

The bill shifts primary oversight of cryptocurrencies from the SEC (Securities and Exchange Commission) to the CFTC (Commodity Futures Trading Commission), which is seen as better suited to treat digital assets as commodities.

2. Optional SEC Registration for Issuers

Crypto projects that wish to raise funds directly from institutional investors will be allowed to voluntarily register with the SEC, maintaining regulatory flexibility.

3. Reduced Regulatory Conflict

The bill aims to end the turf war between the SEC and CFTC, offering legal clarity for companies and investors alike.

Potential Impact on the Crypto Market

The approval of the CLARITY Act could bring significant changes to the U.S. cryptocurrency landscape.

By assigning primary regulatory authority to the CFTC, the bill reduces agency conflicts and provides more legal certainty for businesses operating in the space.

Clear rules could create a more innovation-friendly environment, attracting startups and major players to build in the U.S.

The option for voluntary SEC registration gives crypto issuers added flexibility to access institutional capital.

In practice, this new framework could accelerate capital inflow into the crypto sector and position the U.S. as a global leader in digital asset regulation.

What’s Next?

- Full House vote in the U.S. Congress

- If passed, the bill moves to the U.S. Senate for consideration

- After Senate approval, it can be signed into law or vetoed by the President

Ethereum Attracts Traders with ETF Inflows, Rising Volatility, and SEC Support

Source: The Currency Analyitcs

Ethereum (ETH) is regaining momentum in the crypto market, drawing increasing attention from both traders and institutional investors.

Boosted by strong inflows into Ethereum ETFs, rising volatility in derivatives markets, and positive signals from the SEC regarding DeFi, ETH is outperforming Bitcoin across several short-term metrics.

Ethereum ETFs See Record Inflows

On Tuesday, June 10, Ethereum-backed ETFs recorded $125 million in net inflows — the highest daily volume in the past four months. The standout was BlackRock’s iShares Ethereum Trust (ETHA), which alone accounted for $80 million.

This surge in capital drove ETH up 4.8% on the day, outpacing Bitcoin’s 1% gain, and strengthened the narrative of a new wave of institutional accumulation targeting Ethereum.

ETH Derivatives Lead in Volatility

Ethereum is also leading in implied volatility in options and futures markets. The ETH volatility index is 34% higher than BTC’s, the widest gap since the FTX collapse in 2022.

Additionally, traders are paying higher premiums for long-dated ETH call options, such as those expiring in March 2027.

Funding rates on platforms like Deribit are also higher for ETH, signaling more aggressive bets on future price moves.

Regulatory and Technical Signals Fuel Optimism

Three main drivers are reinforcing renewed interest in Ethereum:

- SEC openness to DeFi:

The U.S. Securities and Exchange Commission’s recent shift toward a more flexible stance on decentralized projects is boosting market confidence. - Vitalik Buterin’s statements:

Ethereum’s co-founder stated that the network could reach 10x scalability within the next 12 months, strengthening its technical outlook. - Potential approval of more Ethereum ETFs in the U.S.:

This could broaden institutional access to ETH and drive further demand.

With ETF momentum, elevated volatility, and a more favorable regulatory climate, Ethereum is back in the spotlight among both traders and institutional players.

Recent data shows strong and consistent capital inflows, as well as a higher risk appetite for ETH versus Bitcoin, signaling a positive outlook for Ethereum in 2025.

Tether Acquires Majority Stake in Gold Mining Company to Strengthen Stablecoin Reserves

Source: CryptoSlate

Tether, the issuer of the USDT stablecoin, has announced the acquisition of a 31.9% stake in Elemental Altus Royalties, a Canadian gold mining company.

The deal was valued at C$121.5 million (approximately R$494 million), making Tether the majority shareholder.

Including shares previously held, Tether now owns a total of 33.7% of the company.

Additionally, Tether has secured a purchase option for an additional 13.9% stake after October 29, 2025. If exercised, Tether’s total ownership could rise to 47.7%, further strengthening its strategic control over the miner.

A Strategic Move to Back Stablecoins with Tangible Assets

The investment aligns with Tether’s long-term strategy of diversifying its reserves with real-world assets like gold, to enhance the stability and credibility of its tokens — particularly Tether Gold (XAUT), its gold-backed stablecoin.

Tether already holds over 80 metric tons of gold and more than 100,000 BTC in reserves. Now, it is expanding into the gold mining sector via a royalty model, which provides passive revenue streams without the operational risks of directly managing mining operations.

Implications for the Crypto and Financial Markets

This acquisition marks a significant step for the stablecoin industry:

- Increases security and trust in Tether’s stablecoins by backing them with tangible assets

- Strengthens Tether Gold (XAUT) as a reliable option during times of economic uncertainty or inflation

- Attracts institutional investors, demonstrating a commitment to transparency, real backing, and long-term sustainability

- Accelerates the convergence between crypto assets and commodities, paving the way for new asset-backed tokens linked to precious metals or energy resources

Tether’s move underscores a broader industry trend: bridging digital finance with physical assets to build more resilient and trusted crypto ecosystems.