Welcome to the innovative world of decentralized finance (DeFi). In today’s post, we’re delving into AAVE, a cutting-edge platform that’s changing how we approach lending and borrowing in the crypto universe.Whether you’re new to the crypto scene or a seasoned investor, this guide will provide you with a comprehensive understanding of what is aave and how to navigate and utilize this project’s diverse offerings.

What is Aave?

Aave, a cornerstone of the DeFi ecosystem, is a decentralized lending system that allows users to lend, borrow, and earn interest on crypto assets without middlemen.

Originally launched as ETHLend in 2017, it was rebranded to Aave in 2018, introducing a more robust and flexible platform.

Operating on the Ethereum blockchain, Aave distinguishes itself with features like liquidity pools and flash loans, offering a unique blend of security, transparency, and efficiency.

Why Use Aave?

Aave stands out for several reasons. It offers attractive interest rates for depositors, potentially higher than traditional banking and other DeFi platforms. Its decentralized structure eliminates the need for intermediaries, cutting down on fees and enhancing user control over financial transactions.

Furthermore, Aave introduces innovative financial tools like flash loans – instant, collateral-free loans repaid within the same transaction, showcasing the platform’s commitment to financial innovation.

How to use Aave crypto?

Below is a step-by-step guide to getting started using the aave cryptocurrency to make loans:

-

Getting Started with Aave

Embarking on your Aave journey is straightforward. First, set up a digital wallet compatible with Ethereum, as Aave is built on the Ethereum network.

Then, acquire Ethereum or any Aave-supported cryptocurrency via a trusted exchange. Once your wallet is funded, connect it to the Aave platform, and you’re ready to explore its features.

-

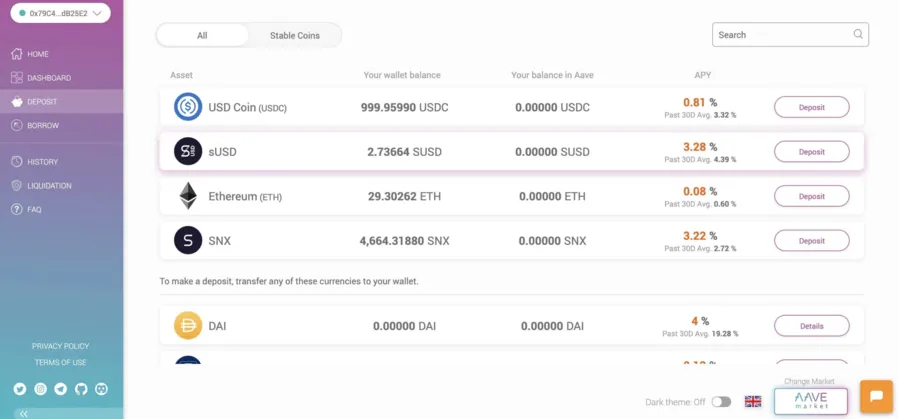

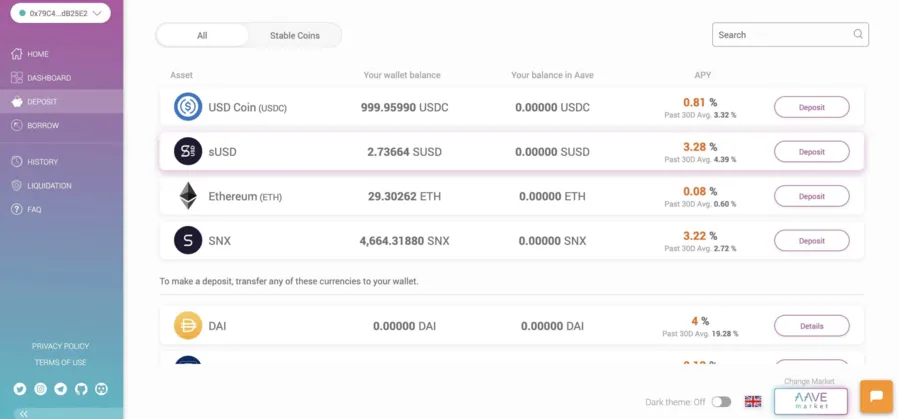

Making Your First Deposit on Aave

Depositing on Aave is a simple process. Once connected to the platform, choose the cryptocurrency you wish to deposit, and transfer it to the corresponding liquidity pool.

Your deposit will start earning interest, which varies based on the asset’s demand. This interest is compounded continuously, maximizing your potential returns.

-

Taking Out Loans on Aave

Borrowing on Aave involves collateralizing your assets. Select the asset you want to borrow, ensure you have sufficient collateral, and choose your interest rate model – stable or variable.

Keep an eye on your loan-to-value ratio to maintain your loan’s health and avoid liquidation.

-

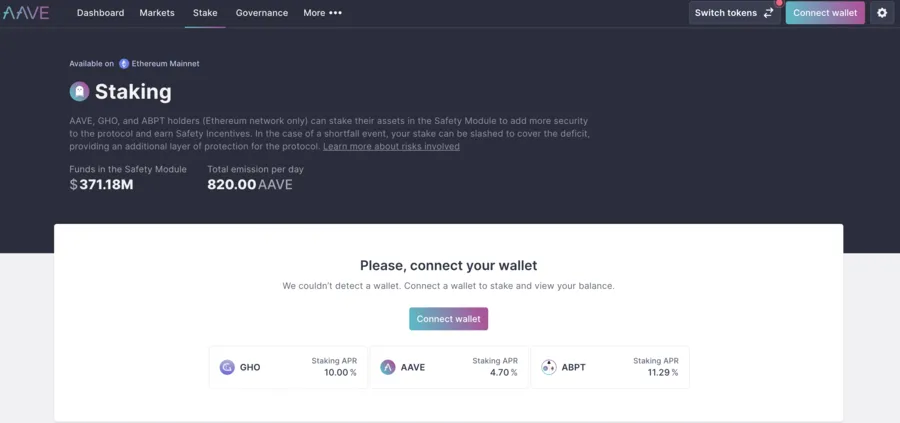

Staking and Governance in Aave

By staking AAVE tokens, users contribute to the platform’s security and earn rewards.

Stakers receive a portion of the platform’s fees and are also involved in Aave’s governance, voting on decisions that shape the future of the platform.

-

Risks and Considerations

While Aave offers numerous opportunities, it’s not without risks. The volatile nature of cryptocurrencies can affect loans and deposits.

There’s also the risk of smart contract vulnerabilities. It’s crucial to understand these risks and practice prudent investment strategies.

Aave is a beacon of innovation in DeFi, offering a plethora of opportunities for managing and growing your crypto assets.

By following this guide, you’re well on your way to making informed decisions and leveraging Aave’s capabilities to your advantage.

The DeFi landscape is ever-evolving, so keep learning and stay informed about the latest developments. And of course, don’t forget to use a good aave wallet to store your tokens safely.