Hello, dear investors. Today we’re going to talk about a very common question in the cryptocurrency market: is the aave project really good and worth the investment?

Well, before making any investment, even a small one, it’s important to study the project thoroughly to make sure we’ll get a good return in the future.

With this in mind, the klever team decided to create this blog post in which we will analyze aave in more depth.

Are you ready?

What is Aave?

Aave is a trailblazer in the DeFi landscape, offering a decentralized lending system where users can lend, borrow, and earn interest on crypto assets.

What sets Aave apart is its innovative approach to finance, allowing users to engage in these transactions without traditional financial intermediaries.

For investors, maintaining assets in an aave wallet not only ensures security but also plays a crucial role in their investment strategies.

How does AAVE work?

AAVE crypto uses liquidity pools for lending, where users deposit crypto to earn interest. Borrowers over-collateralized loans, offering extra security against defaults.

This system ensures a stable, risk-minimized environment for both lenders and borrowers. For a more detailed explanation of how AAVE works, check out our comprehensive post on the topic.

Agora que você já entendeu mais sobre o que é a aave, e como ela funciona, vamos a seguinte pergunta…

Is aave crypto a good investment?

As you already know, aave is part of the decentralized lending sector, and is even one of the most promising narratives for the next bull market cycle.

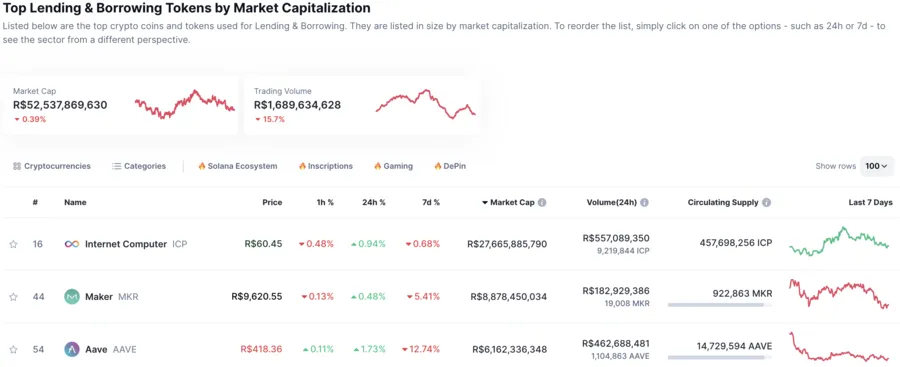

In addition, according to the image below from coinmarketcap, you can see that AAVE is currently the third largest project in the sector by market capitalization, with just over $1 billion in market value.

Source: coinmarketcap

In addition to already being a very well-established project within the crypto world and DEFI, AAVE, which was created in 2020, has already gone through bull market cycles and especially bear market cycles, when most cryptocurrencies tend to be down in relation to other assets.

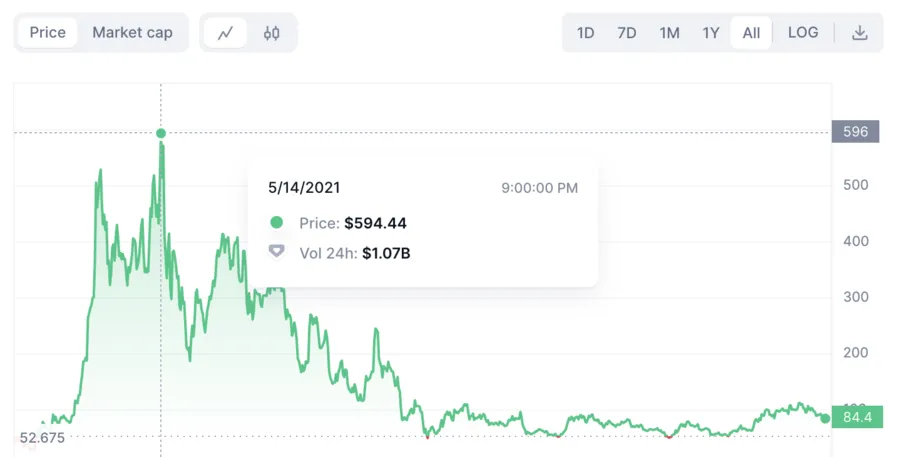

AAVE’s All Time High was at the top of the 2021 bull market, where it reached $594 per unit of its token.

At the time of writing, AAVE’s token value was between $85 and $90 per unit.

If we consider that in the next bull market, in a conservative scenario, this cryptocurrency only returns to its historical high, we would already be talking about a possible multiplication of capital of just over 6x the amount invested.

Taking a slightly more realistic view, some analysts are projecting that AAVE tokens could even reach $1,000 per unit in the next boom cycle, which would give a possible return of just over 10x its current value.

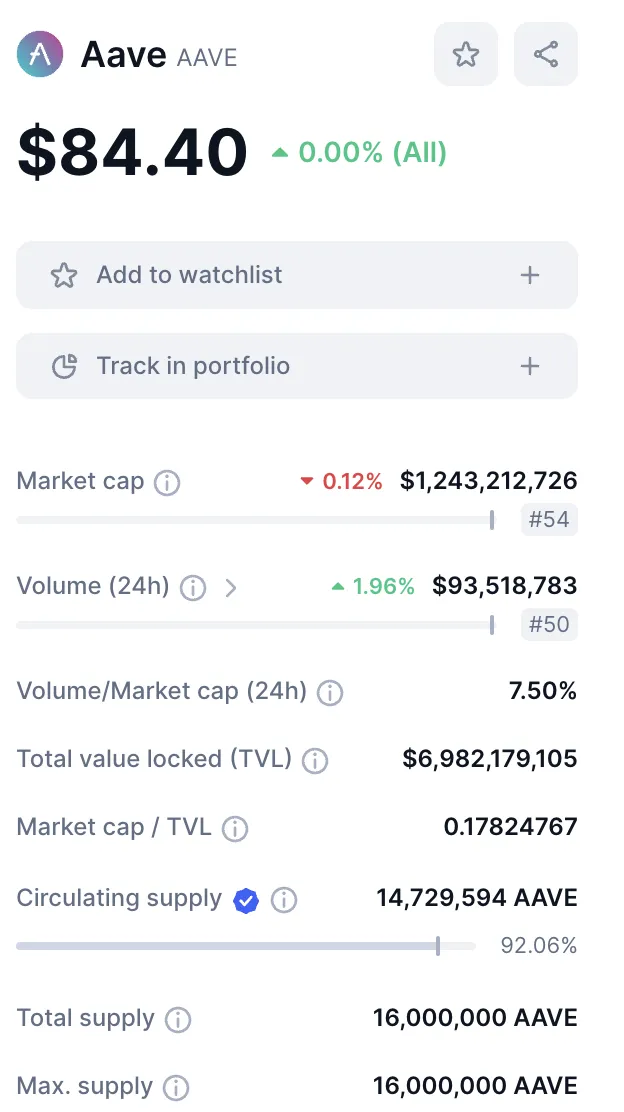

When we look at its TVL and supply, two other important factors to analyze when thinking about investing in a cryptocurrency project, they certainly don’t fall short.

As you can see below, the project has an excellent TVL (Total Value Locked) of almost $7 billion. The project also has an excellent supply, with only 16 million coins on the market, 92.06% of which are already held by retail and institutional investors.

Investing in Aave comes with its set of advantages. Its pioneering role in the DeFi sector suggests a strong potential for growth and innovation.

The platform’s increasing adoption is a positive sign for investors, indicating a growing trust and interest in Aave. Moreover, the opportunity to earn staking rewards makes Aave an attractive option for those looking to accumulate passive income.

Therefore, it can be seen that AAVE is a great project in the crypto world, and is already very well established within the decentralized finance universe.

In any case, it’s important to bear in mind that like other projects, AAVE has its risks and that before you buy aave and start investing in this project, you should study it further.