Hey, crypto fans!

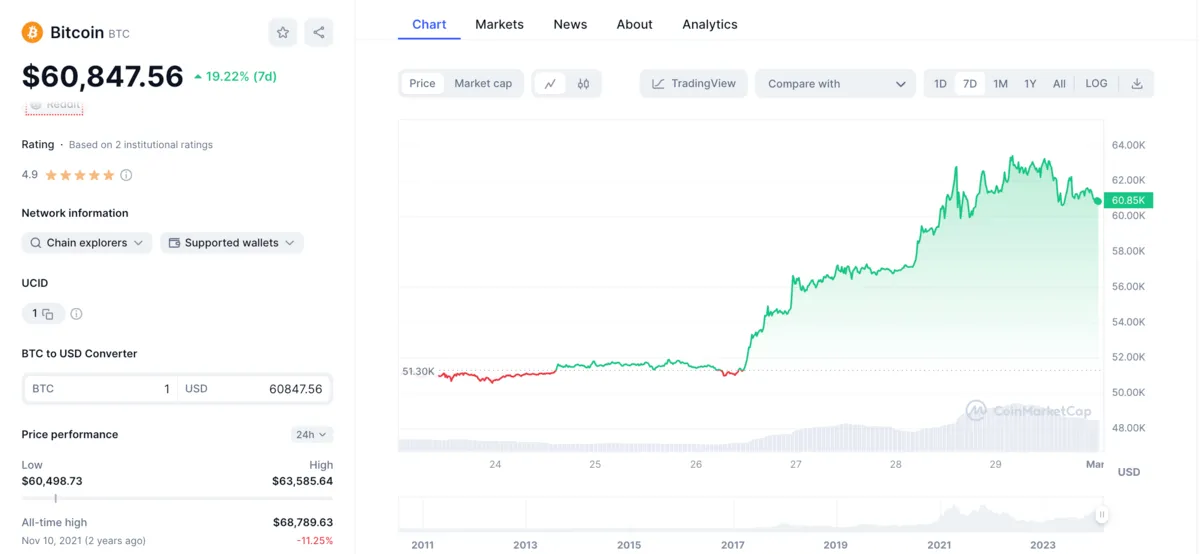

Wondering how Bitcoin is shaping the market in this vibrant bull season? This week, Bitcoin not only navigated the bullish waves but also led the charge, soaring from $51,293.58 to an impressive $60,891.11, by the time of this article. This ascent, marking a robust 18.71% increase and enriching its value by $9,597.53, underscores Bitcoin’s unwavering influence. As it thrives, Bitcoin paves the way for the altcoin season, inspiring a cascade of momentum across the crypto landscape.

For those delving into what is Bitcoin, its recent surge exemplifies its role as a beacon, guiding both seasoned investors and newcomers through the thrilling decentralized finance.

What is Bitcoin?

Bitcoin, a groundbreaking cryptocurrency, was conceptualized in a 2008 whitepaper by an enigmatic figure or group under the pseudonym Satoshi Nakamoto. This whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” laid the groundwork for a new form of money that operates independently of centralized financial institutions. The Bitcoin network officially came to life in January 2009 with the mining of the genesis block, marking the beginning of decentralized finance as we know it.

Operating on a decentralized network of computers, Bitcoin is immune to control by any single entity, ensuring transactions are transparent, secure, and resistant to censorship. Its underlying technology, blockchain, is a public ledger where all transactions are recorded, verified by a consensus of network participants rather than a central authority.

How bitcoin works for beginners

Understanding how Bitcoin works can initially seem complex, but it can be broken down into more accessible concepts:

1. Blockchain Technology

At the heart of Bitcoin is the blockchain, a public, digital ledger that records all transactions across a network of computers. This ledger is not stored in any single location, making it immune to central points of failure and censorship. Every transaction is verified by network participants (called nodes) and then combined with others to form a new block of data for the ledger.

2. Transactions

A Bitcoin transaction involves the transfer of Bitcoin value from one digital wallet to another. Each wallet has a unique address, somewhat like an email address, that indicates where the Bitcoin is sent or received. Transactions are signed with a digital signature, proving the owner has authorized the transfer of Bitcoin without revealing their identity.

3. Mining

Bitcoin mining underpins the currency’s ecosystem, ensuring network security and introducing new Bitcoins. Miners employ advanced computers to resolve complex problems, adding blocks to the blockchain for rewards in new Bitcoins. The Bitcoin halving, pivotal to controlling supply, halves the mining reward every 210,000 blocks, curbing inflation by slowing the release of new coins, thus preserving Bitcoin’s value over time.

4. Decentralization

Unlike traditional currencies, Bitcoin operates on a decentralized network of computers. There’s no central authority, like a government or bank, controlling it. This decentralization means that Bitcoin operates on a peer-to-peer network, making transactions direct between users.

5. Supply Limit

Bitcoin has a capped supply limit of 21 million coins, a feature that aims to mimic the scarcity and value preservation similar to precious metals like gold. This finite supply helps prevent inflation, which is a common issue in traditional fiat currencies managed by governments.

6. Wallets

Bitcoin wallet is a digital tool, that allow users to store, send, and receive Bitcoin. They come in various forms, including hardware wallets (physical devices), software wallets (programs or mobile apps), and paper wallets (printed keys).

7. Volatility

Bitcoin’s price can be highly volatile, influenced by factors such as market demand, investor sentiment, regulatory news, and technological developments. This volatility can lead to significant price fluctuations in a short period.

8. Security

While the Bitcoin network itself is extremely secure, individual wallets can be vulnerable if not properly protected. Practices like keeping private keys secure, using two-factor authentication, and choosing reputable wallets and exchanges are crucial for safeguarding one’s Bitcoin.

Bitcoin’s Impact: Catalyzing the Blockchain Revolution and Financial Inclusion

Bitcoin’s groundbreaking introduction has done more than redefine money; it has unlocked the door to a wave of digital currencies and blockchain innovations, challenging conventional financial systems. Its pioneering blockchain technology has become the foundation for notable cryptocurrencies and platforms such as Ethereum (ETH), which introduced smart contract capabilities; Tron (TRX), aimed at creating a decentralized web; and KleverChain (KLV), designed to streamline and secure smart contracts and decentralized applications.

Beyond serving as a digital currency, Bitcoin has ignited a global shift towards financial autonomy and inclusion. It advocates for a transparent, secure system that operates independently of traditional financial institutions. As Bitcoin evolves, it continues to lead the digital finance revolution, symbolizing a movement towards a more accessible and equitable financial ecosystem. Bitcoin’s legacy has not only spurred technological advancements but also inspired a shift in perspective regarding the decentralization of authority and the democratization of finance.

Bitcoin Tokenomics

1. Overview

Token Symbol: BTC

Blockchain: Bitcoin

Token Type: Cryptocurrency

Utility: Digital gold, store of value, medium of exchange, unit of account.

2. Allocation and Supply

Total Supply: Capped at 21 million BTC.

Circulating Supply: Dynamic, reflecting mining activity and release into the ecosystem.

3. Utility and Rewards

In-Blockchain Use: Peer-to-peer transactions, payment for goods and services.

Staking: Not applicable due to Proof of Work consensus.

Governance: Decentralized, community-driven development and upgrades.

4. Economic Model

Deflationary Mechanisms: Halving events reducing block rewards, capped supply.

Reward Distribution: Miner rewards for block discovery and transaction processing.

5. Market Performance*

Source: Coin Market Cap

Current Price: Around $60,847 to $60,940*

Market Cap: Approximately US$1.19 trillion

24h Volume: Approximately BTC 461.29 million, equivalent to around US$28.09 trillion in volume.

All-time High: $68,789.63 on Nov 10, 2021

All-time Low: $0.04865 on Jul 14, 2010

* BTC Performance on Feb 29, 2024

Managing BTC in a Klever Wallet

The Klever Wallet is a user-friendly platform for managing a wide range of cryptocurrencies, now expanding its support to 30 blockchains. It makes buying Bitcoin easy through various payment methods and allows for btc crypto swaps without the need for signing up. Additionally, it offers secure ways to send, receive, and store bitcoin and +10,000 tokens and NFTS.

For heightened security, Klever introduces KleverSafe. This device keeps your Bitcoin safe by storing it offline, away from potential online threats, offering a secure way to protect your digital assets. This combination of accessibility and security makes KleverSafe a solid choice for anyone looking to keep their cryptocurrencies safe and easily manageable.