Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial advice. Investing in cryptocurrencies, including Ethereum ETFs, involves risks, and you should conduct your own research and consult with a financial advisor before making any investment decisions

The recent approval of Ethereum ETFs by the U.S. Securities and Exchange Commission marks a significant and optimistic turning point for the broader cryptocurrency industry. This progressive move not only validates Ethereum’s place in the financial mainstream but also acts as a catalyst for the acceptance of additional blockchain technologies and cryptocurrency ETFs.

Such developments are poised to enhance the accessibility and appeal of digital assets through regulated, familiar investment vehicles. By bridging the gap between innovative blockchain solutions and traditional financial markets, this approval could drive a new wave of institutional and retail investment, bringing enhanced stability, liquidity, and growth to the crypto ecosystem. This positive outlook is a beacon for investors and developers alike, signaling a maturing market that is increasingly recognized by regulatory bodies and financial institutions. Keep reading and find out

What are Ethereum ETFs and How Do They Function?

Ethereum ETFs (Exchange Traded Funds) offer a straightforward way for investors to gain exposure to Ethereum without the need to manage the actual cryptocurrency. These funds are traded on stock exchanges and mirror the price movements of Ethereum, simplifying the investment process for those unfamiliar with digital wallets like swissmoney and blockchain technology.

What Led to the SEC’s Approval of Ethereum ETFs?

The SEC’s decision to approve Ethereum ETFs was influenced by Ethereum’s increasing stability and acceptance as a legitimate asset class. This major approval paves the way for traditional investors to engage with cryptocurrencies in a regulated environment, offering a bridge between conventional finance and the burgeoning field of digital assets.

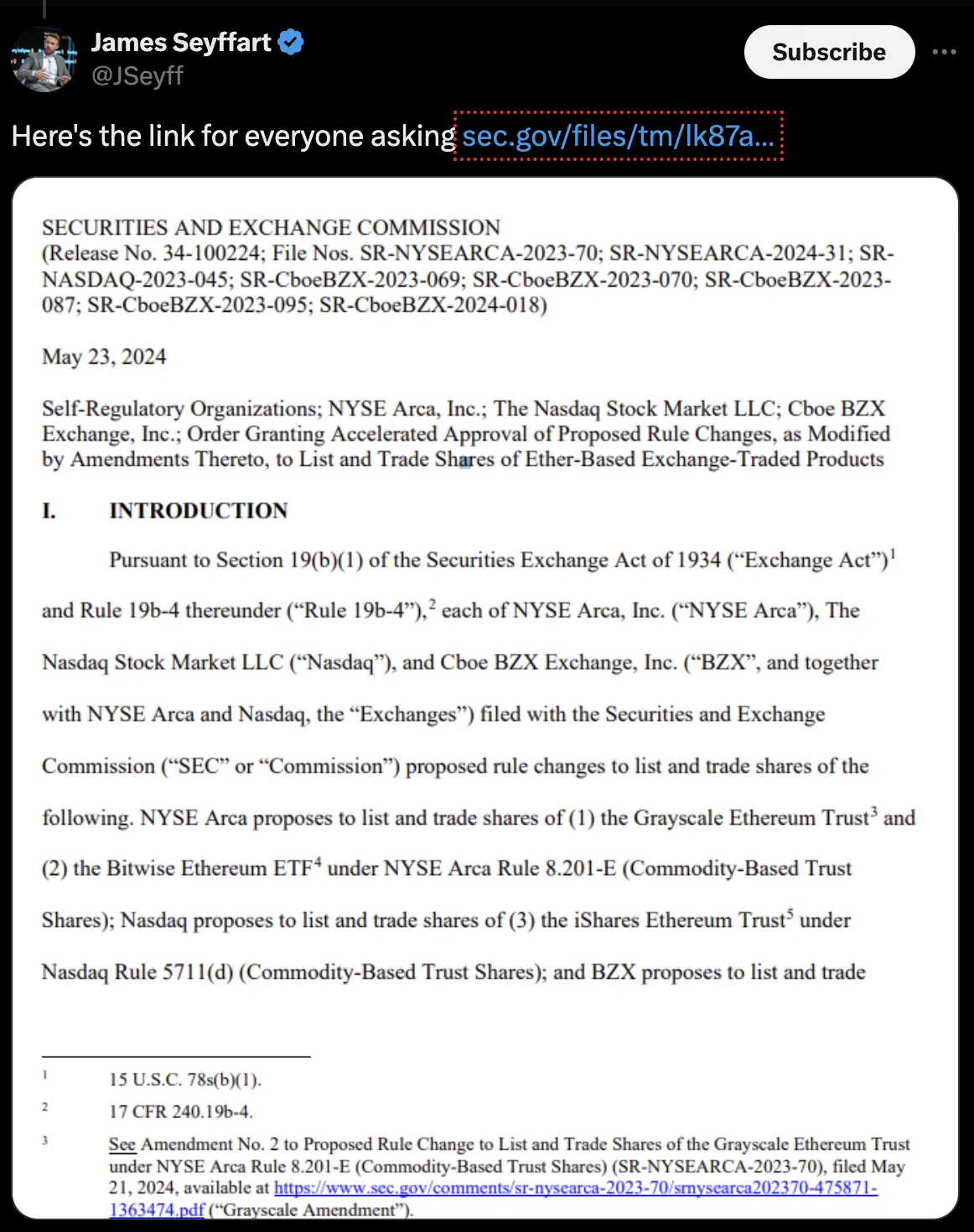

Source: James Seyffart on X

How Does the SEC’s Approval Affect Ethereum’s Commodity Status?

By approving Ethereum ETFs, the SEC tacitly endorses Ethereum‘s status closer to that of a commodity, akin to gold or oil. This classification could lead to broader institutional investment and a more stable pricing framework, making Ethereum an attractive asset for diversified investment portfolios.

Is there any ETF for Ethereum?

Yes, there are Ethereum ETFs available. For instance, Franklin Templeton has listed a spot Ethereum ETF on the Depository Trust and Clearing Corporation (DTCC), indicating its availability for creation and redemption, though final SEC approval is still pending .

Additionally, there’s an active discussion and anticipation surrounding the approval of other spot Ethereum ETFs, with firms like BlackRock, Fidelity, and Invesco among the applicants.

What Impact Could Ethereum ETFs Have on the Crypto Market?

Ethereum ETFs are expected to inject significant liquidity into the cryptocurrency market, potentially stabilizing Ethereum’s price fluctuations.They provide a vehicle for large-scale, conservative investors to participate in the crypto economy, potentially leading to greater maturity and less volatility across the market.

Exploring the Benefits and Risks of Investing in Ethereum ETFs

Investing in Ethereum ETFs allows investors to leverage the potential gains of Ethereum without the technical challenges of managing cryptocurrencies. However, potential investors should be aware of the volatility inherent in crypto markets and the regulatory landscape, which could impact future valuations.

What are the advantages of owning Ethereum directly instead of through an ETF?

Owning Ethereum (ETH) tokens directly through a crypto wallet, like the Klever app gives users true ownership and control over their assets, unlike investing in an Ethereum ETF. With direct ownership, individuals hold the private keys to their ETH, enabling them to transact and use their tokens freely within the blockchain ecosystem. In contrast, an Ethereum ETF represents a share in a fund that owns Ethereum, where the investor has exposure to the price movements of Ethereum but does not own the actual cryptocurrency. This distinction is crucial for those looking to have real control and use of their digital assets versus merely investing for financial gain.

How can I invest in ETH?

Investing in Ethereum (ETH) offers several pathways, each catering to different investor needs and expertise levels. Before making any movement, do your own research and only invest money you can afford to lose.

If you already made up your mind, here’s a precise guide with many options for you to invest in Ethereum ETH tokens.

-

Buying Ethereum on Cryptocurrency Exchanges: For those new to digital currencies, purchasing Ethereum through leading cryptocurrency exchanges, and it is a practical choice. These platforms support direct purchases using fiat currencies such as USD, EUR, and GBP, making them accessible for beginners. Pay attention to the transaction fees and never leave your money in an exchange.

-

Investing through Online Brokerage Platforms: Online Brokerage Platforms offer a user-friendly interface for those accustomed to traditional stock trading. Investing in Ethereum through these brokers allows users to leverage tools familiar from equity trading, enhancing the transition to cryptocurrency investments.

-

Utilizing Decentralized Exchanges (DEXs): For a more hands-on approach, decentralized platforms such as defi.bitcoin.me allow for direct peer-to-peer transactions. This method appeals to those seeking to invest in Ethereum without intermediary oversight, providing a higher degree of control over their digital assets.

-

Ethereum ETFs and Investment Funds: For investors preferring traditional investment vehicles, Ethereum ETFs represent a viable option. These funds offer exposure to Ethereum’s price movements without the need to directly purchase or manage the underlying cryptocurrencies, simplifying the investment process significantly.

-

Purchasing and Managing Ethereum ETH via Web3 Wallets: Buying Ethereum ETH directly and managing it through web3 wallets like Klever Wallet or Klever Extension offers full control over your investments. This method not only allows for buying and holding Ethereum but also participating on the decentralized applications built on the Ethereum blockchain.

-

Automated Ethereum Investment Strategies: For those looking for a hands-off investment approach, crypto robo-advisors and automated trading platforms can manage your Ethereum investments. These tools adjust your holdings based on algorithmic trading strategies, tailored to your risk tolerance and investment goals.

For those looking to take real ownership of Ethereum (ETH) and fully engage with the Ethereum ecosystem, a reliable Web3 wallet is essential. With a versatile ETH Web3 wallet, you can buy ETH tokens, as well as send, receive, and swap ETH for other tokens seamlessly. Additionally, a comprehensive Web3 wallet also provides access to Ethereum-based decentralized applications (DApps) through an integrated multichain browser extension. Download Klever Wallet today and manage ETH and thousands of Ethereum tokens with thecsafety and agility that only Klever provides.