Hey crypto friends!

Today we’re going to dive into a question that many of you may still be wondering: why transfer your assets from an exchange to a wallet? What is the fundamental difference between these two crypto offer options? Well, then fasten your seatbelts – we will go into all the details and doubts away from you. Are you ready to immerse yourself in the world of knowledge? Let’s go!

Crypto Exchange vs Crypto Wallet

Cryptocurrency Exchanges is a digital platform where you can buy, sell and try a vast array of cryptocurrencies. Exchanges allow investing in diversification with various assets. There are two fundamentally different types of exchange platforms:

- Centralized exchanges: users’ funds in custody, with their help being intermediaries

- DEX or a decentralized exchange: it works on the blockchain and direct trading between users it does not have custody, uses non-custodial wallets.

In addition to everything, exchanges are trading floors of cryptocurrencies. When we talk about investing in buy-it-low-sell-it-high trading these environments are the primary place to go. Where investors buy cheaper and sell them more expensive in search of greater profits. Thus, to find out how to maximize all the profits, you need to know how this relationship works in the market.

In the other corner is the digital Crypto Wallet, which works the same as any digital wallet, but here you can safely store, send, receive digital currencies and much more without risk. The types of e-wallets are as follows:

1. Hardware wallets – such as KleverSafe, which store your keys offline.

2. Online wallets – are Internet-based and can be accessed from anywhere, mobile versions include Klever Wallet app and a browser extension, for desktop users, such as Klever Extension.

3. Paper wallets – Literally, physical pieces of paper that contain information about your cryptocurrency.

These wallets protect your cryptocurrencies using security keys, necessary to access your funds, public addresses, send, and receive cryptocurrencies. They help secure your transactions and allow you to send money directly to others, without the need for intermediaries like a bank.

Why You Should Transfer Your Assets from an Exchange to a Wallet

Transferring your cryptocurrency from an exchange to a wallet significantly boosts the security of your investments. By moving your assets to a wallet, you gain personal control over your cryptocurrencies, reducing the risk associated with exchange vulnerabilities, such as hacks or operational failures.

Let’s dive deeper into it.

-

Enhanced portfolio security: Wallets are less targeted than exchanges. For self-custodial wallets, you assets are truly yours because you have the private keys, always remember – Your keys, your coins

-

Lower Risk of Problems with Exchanges: Keeping your assets in a self-custodial wallet helps protect you from issues like exchange bankruptcies or legal troubles, making sure your investments stay safe.

-

Privacy Considerations: Using a wallet can enhance your transaction privacy by minimizing the traceability of your personal identity, especially with non-custodial options.

-

Long-Term Holding and Estate Planning: Wallets are good for safely storing investments for a long time and make it easier to include digital assets in plans for passing on your wealth, allowing you to easily give them to your family members in the future.

-

Trade-off: While exchanges offer more liquidity and accessibility, wallets prioritize your security and control.

To move or not to move the assets from an exchange?

To move or not to move? This is the question! Keeping your assets in an exchange has some pros and cons, so let’s review them:

Advantages of keeping your assets in an exchange

-

Convenience: Crypto exchanges provide a user-friendly platform for buying, selling, and trading cryptocurrencies. Users can easily manage their portfolios, execute trades quickly, and access a variety of digital assets all in one place.

-

Liquidity: Exchanges typically have high liquidity, which makes it easier to buy or sell large amounts of cryptocurrencies without a significant impact on the price. This is particularly important for traders who need to quickly enter or exit positions.

-

Advanced Trading Tools: Many exchanges offer advanced trading features, such as futures and options, margin trading, stop-loss orders, and other trading tools that can help traders manage risk and capitalize on market opportunities.

-

Integration of Services: Some exchanges offer integrated services such as staking, lending, or earning interest on crypto holdings. These services can help users generate additional income from their investments without needing to move funds to different platforms.

-

Support and Accessibility: Exchanges often provide robust customer support, educational resources for learning about cryptocurrency and trading strategies, and mobile apps for trading on the go. This level of support and accessibility can be especially helpful for newer users navigating the complexities of the crypto market.

Disadvantages of keeping your portfolio in an exchange

-

Security Risks: Giving exchanges access to your funds poses a risk. If the exchange goes bankrupt, you could lose your assets.

-

Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving. Exchanges can be suddenly affected by new regulations or enforcement actions, which might include freezing assets or shutting down operations entirely, potentially restricting access to your funds.

-

Hacking Threats: Exchanges are vulnerable to hackers because they often lack secure keys.

-

Limited Regulation: There’s minimal specific regulation overseeing exchange activities, though you must report investments to the Tax Authority.

-

Liquidity Issues: In cases of extreme market volatility or internal problems, an exchange might temporarily halt trading or withdrawals, leaving you unable to access your funds when you most need or want to.

-

Operational Risks: Exchanges can face technical issues, from downtime due to maintenance to glitches in trading systems. These can prevent you from executing trades or withdrawals timely and might lead to financial losses, especially in a highly volatile market environment.

-

Lack of Control: When you keep your funds on an exchange, you don’t have control over your private keys; the exchange does. This means you rely on the exchange’s security measures and policies to manage your funds, as opposed to having direct control when using a self-custodial wallet.

DeFi Hacks and the Urgency for Improved Security Measures

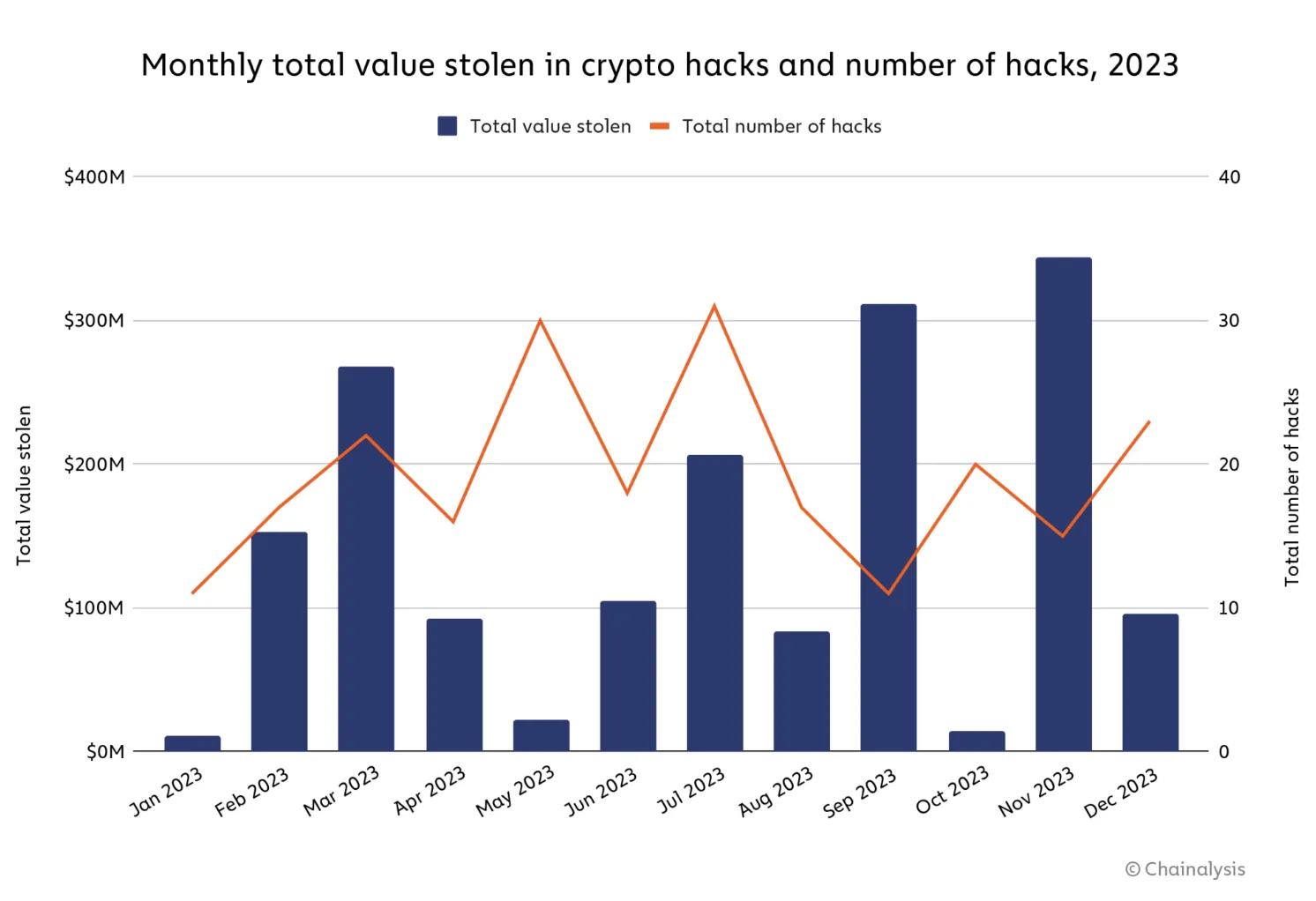

The chart of DeFi hacks value from 2019 to 2023 presents exponential growth of the frequency and scale of breaches, with the peak registered in 2022. The DeFi hacks phenomenon started with minimal volumes in 2019, at only one incident. However, the number of hacks rapidly grew to 34 in 2020 and further to 141 in 2021, thus indicating an extremely dangerous trend. The financial costs of the hacks grew in a similar way to the incident, reaching more than $3 billion the same year in 2022. However, in 2023, the number of incidents and the value lost was significantly reduced: 172 hacks caused less than $2 billion loss. The decrease in total stolen value may signal that cybersecurity measures have successfully improved or that the attackers have moved to other targets. The overall emergence trend indicates an increasing threat level in the DeFi environment, signifying the importance of continuous cybersecurity measures improvement.

For example, this trend underscores the ongoing necessity for enhanced security practices within the DeFi sector. As such, it is crucial for individuals to adopt rigorous security measures: this includes safeguarding private keys and seed phrases, using alternative addresses for airdrops instead of main wallets, exercising caution when connecting to decentralized applications (dApps), and considering the use of offline wallets for storing substantial crypto assets. Implementing these precautions can help ensure a secure experience in the evolving landscape of digital finance.

So, if you have enough of paying exorbitant fees from transferring assets from one place to another! Download the Klever Wallet app, your all in one multi-chain wallet supporting over 30 blockchains, thousands of tokens, and NFTs. Plus, you get direct access to dApps, can buy crypto inside the wallet using credit cards, online payments, and bank transfers, and even swap between more than 500 trading pairs right inside the app. Yes, Klever Wallet includes a built-in exchange tool that simplifies all your crypto transactions.

So what are you waiting for? Meet Klever, a complete ecosystem for managing crypto tailored for every crypto need.