After months of anticipation, marked by several false starts and misinformation incidents like the compromised SEC innacurated tweet, the U.S. Securities and Exchange Commission (SEC) has finally approved a series of spot Bitcoin ETFs in U.S Exchanges. This decision has been long awaited by the cryptocurrency community, with the first application for a spot Bitcoin ETF filed way back in 2013 by Tyler and Cameron Winklevoss.

Among the high-profile applications for Bitcoin ETFs were those by BlackRock, Fidelity, Invesco, and Grayscale Investments. BlackRock’s application, in particular, was seen as a significant move given its status as the world’s largest asset manager. This series of applications marked a turning point, showing the growing interest from traditional financial institutions in the cryptocurrency space.

This groundbreaking move paves the way for mainstream investors to tap into Bitcoin’s potential without the complexities and responsibilities of direct ownership. It’s a game-changer, signaling a new level of institutional endorsement for Bitcoin.

This article will dive into what the Bitcoin ETF approval means to you, Klever user and also, of course, for those asking themselves, “ok, SEC approved Bitcoin. What now?“.

Get ready to explore how this decision could revolutionize your approach to Bitcoin investment.

(Source: SEC DELETED FAKE TWEET @SECGOV)

Simply put, a Bitcoin ETF (Exchange-Traded Fund) is a financial instrument that tracks the price and performance of Bitcoin, allowing investors to invest in Bitcoin without actually owning the digital currency. Essentially, a Bitcoin ETF is a fund that holds Bitcoin as its primary asset, and investors purchase shares in the ETF, not the Bitcoin itself.

How does a Bitcoin ETF work?

You already learn that Bitcoin ETFs function in a way that allows investors to gain exposure to Bitcoin’s price movements without owning the cryptocurrency directly. But what does it mean, in simple terms?

Structure: A Bitcoin ETF is structured as a trust or fund that holds Bitcoin as its underlying asset. The ETF issues shares or units that represent ownership in the Bitcoin it holds.

Creation and Redemption: Authorized participants, usually large institutional investors or market makers, are responsible for creating and redeeming shares of the Bitcoin ETF. They deposit the required amount of Bitcoin with the ETF to create new shares and receive shares representing their ownership. Conversely, when they wish to redeem shares, they return them to the ETF in exchange for the underlying Bitcoin.

Price Tracking: The ETF’s primary objective is to track the price of Bitcoin. It might hold a specific amount of Bitcoin for each share or use derivatives, such as futures contracts, to achieve this price exposure. The goal is for the ETF’s performance to closely mirror the price movements of Bitcoin.

Exchange Trading: Similar to regular stocks, Bitcoin ETFs are listed and traded on stock exchanges. Investors can buy and sell shares through their brokerage accounts during regular trading hours. These shares have ticker symbols and are tracked in real time.

Net Asset Value (NAV): The NAV of a Bitcoin ETF represents the value of the underlying Bitcoin assets. It’s typically calculated at the end of each trading day based on the current market value of the Bitcoin holdings. NAV per share helps investors understand the value of their investment.

Fees: Management fees and other expenses are associated with Bitcoin ETFs, usually expressed as a percentage of the ETF’s net asset value. These fees cover the costs of managing the ETF, including custody, administration, and other operational expenses.

Regulation: Bitcoin ETFs are subject to regulatory oversight. Financial authorities in the jurisdiction where the ETFs are offered set regulations and requirements. These regulations aim to provide investor protection and ensure transparency in ETF operations.

The Impact of SEC’s Decision

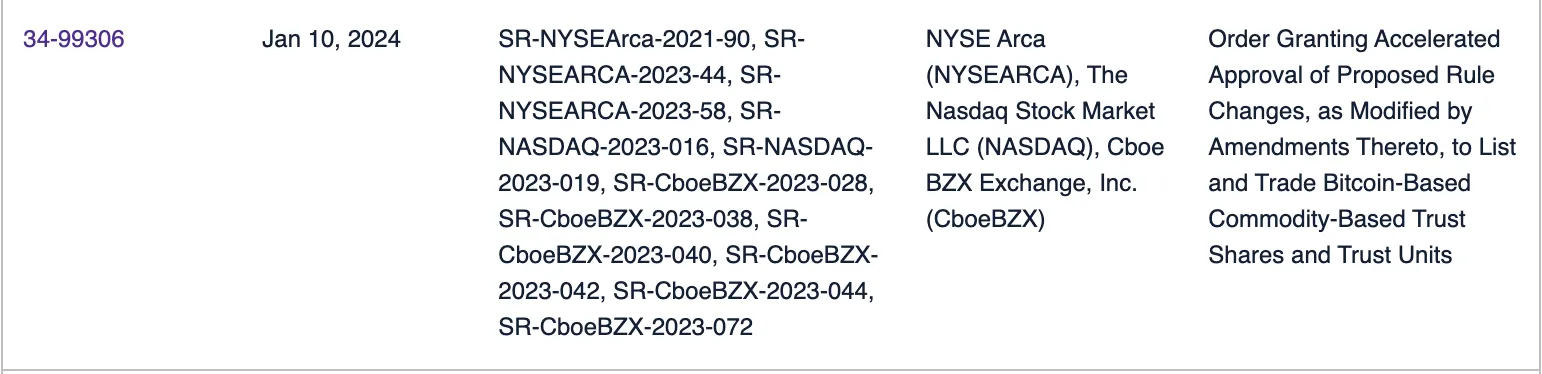

(Source: https://www.sec.gov/rules/sro/national-securities-exchanges)

The SEC’s approval of Bitcoin ETFs in U.S Exchanges marks a pivotal moment in cryptocurrency investment, broadening the appeal of Bitcoin to a more diverse investor base. For seasoned crypto enthusiasts, this development can signify a maturing market with increased legitimacy and potentially more stable investment options. It could lead to greater institutional investment in Bitcoin, which may enhance market stability and liquidity.

For new crypto investors, Bitcoin ETFs offer a less intimidating entry point. They provide a familiar investment structure through traditional stock exchanges, removing the need for understanding the intricacies of cryptocurrency exchanges or wallet security. This ease of access could lead to a surge in Bitcoin’s popularity among mainstream investors.

Overall, the approval is likely to infuse the Bitcoin market with fresh capital and interest, potentially driving up the price and popularity of Bitcoin. However, it also brings an added layer of regulatory scrutiny and mainstream financial market dynamics into play, which could influence Bitcoin’s future growth trajectory.

Click here to check the full SEC’s BTC ETF decision.

BTC Mining and ETFs: The Connection

The relationship between Bitcoin mining and ETFs is an intriguing aspect of the cryptocurrency landscape, particularly as we approach the Bitcoin halving event in April 2024. Bitcoin mining is the process that maintains the blockchain, creating new coins and confirming transactions. The halving event, occurring approximately every four years, will reduce the reward for mining new blocks by half, potentially impacting the profitability of mining.

The introduction of Bitcoin ETFs could lead to increased Bitcoin demand and potentially higher prices, which might offset the reduced mining rewards post-halving. A surge in Bitcoin prices due to ETF-driven investment can make mining more attractive, even with the reduced rewards. Moreover, if ETFs contribute to greater Bitcoin market stability, this could benefit miners by providing a more predictable economic environment for their operations.

However, it’s important to recognize that while Bitcoin ETFs could indirectly affect the mining sector, they don’t interact directly with the Bitcoin mining process. Their primary role is to track Bitcoin’s market price, not to influence the mechanics of its supply or the specifics of the mining process.

Maximize Your Bitcoin Investments with Klever Wallet

Klever emerges as a potent tool for those looking to maximize their Bitcoin investments in this new era of BTC ETFs. It’s designed to streamline the process of buying Bitcoin, offering an accessible platform for everyone, from newbies to expert investors. With Klever, users can easily manage their BTC wallet, leveraging its user-friendly interface to navigate the crypto market confidently.

Beyond mere purchasing btc, Klever facilitates the swapping of several BTC pairs, such as BTC-USDT, USDT-BTC, ETH-BTC, BTC-ETH and more than 20 BTC pairs inside the Klever Wallet. This feature is invaluable for investors looking to diversify their portfolios or shift their investment focus to Bitcoin, especially in light of the evolving market dynamics post-ETF approval.

A key advantage of using the Klever Wallet lies in its security and convenience. It provides a safe environment for managing and storing Bitcoin, addressing one of the most critical concerns in cryptocurrency investment: security. With robust features and an emphasis on user experience, Klever Wallet stands out as an essential tool for you, looking to leverage the full potential of Bitcoin investment in the current landscape.

Securing Your BTC Holdings with KleverSafe

In 2024, securing your assets is non-negotiable and pretty much common sense, right?

This is where solutions like KleverSafe, the Klever Hardware Wallet come into play, offering robust protection for your Bitcoin assets.

KleverSafe provides an enhanced layer of security, ensuring that your digital investments are safeguarded against unauthorized access and potential threats. It acts as a digital fortress, keeping your Bitcoin secure while still easily accessible for legitimate transactions.

Hardware wallets offer another level of security. They store your private keys offline, making them immune to online hacking attempts. By securing your Bitcoin in a hardware wallet, you physically own and control your digital assets. This method is highly recommended for those holding significant amounts of Bitcoin, as it combines high security with ease of access.

KleverSafe represents a comprehensive approach to securing your Bitcoin investments, giving you peace of mind in this often volatile crypto market.

As we embrace the new landscape of Bitcoin investment post-SEC ETF approval, remember that tools like Klever Wallet and KleverSafe are pivotal for maximizing and securing your investments. They offer a blend of accessibility, security, and convenience, ideal for every Bitcoiner.

Download the Klever Wallet today, get your KleverSafe and maximize the safety of your bitcoins, and start securing your Bitcoin assets like a pro.

Be Your Bank – Be Klever