This week, we’re diving into Karura (KAR)—the DeFi powerhouse built for Kusama, designed to make staking, lending, and stablecoin solutions faster and more efficient.

Maybe you’ve heard of KAR but haven’t really looked into it, or you’re wondering what makes it different in the ever-growing world of decentralized finance. Either way, we’ve got you covered.

Stick around as we break down how Karura works, why it matters, and how you can get involved.

Let’s jump in!

What is Karura (KAR)?

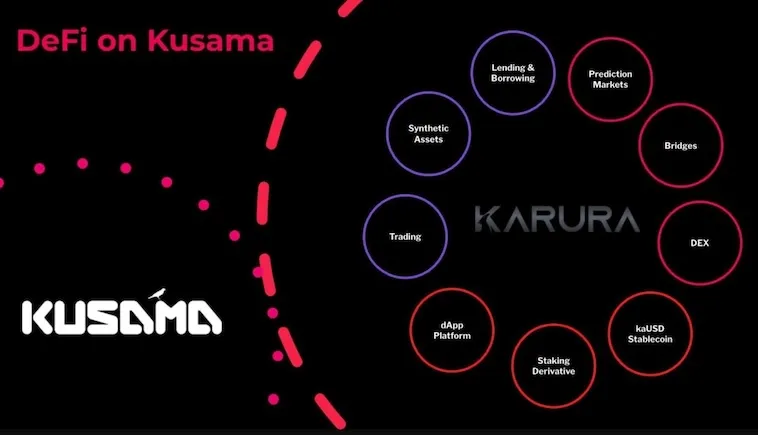

Karura (KAR) is a decentralized finance (DeFi) platform built on the Kusama network, which is often referred to as Polkadot’s canary network. It is designed to serve as an all-in-one DeFi hub, offering a range of financial services including a decentralized exchange (DEX), a crypto-collateralized stablecoin (kUSD), and a staking platform.

This coin aims to provide a scalable and interoperable platform for DeFi applications, leveraging the unique features of the Kusama network. The platform’s native token, KAR, is used for various network activities such as paying transaction fees, participating in governance, and earning staking rewards.

How does Karura (KAR) work?

Karura, functioning as a parachain on Kusama, offers a platform for creating efficient and cost-effective financial applications. It features a multi-collateralized stablecoin (kUSD), backed by cross-chain assets, and a decentralized exchange (DEX) with an automated market maker (AMM) to facilitate liquidity and financial innovation.

As the DeFi hub of Kusama, Karura provides a foundation for early-stage Polkadot projects and radical innovations. Its ecosystem includes multichain liquid staking tokens (like liquid KSM – LKSM), an AMM DEX, and an EVM-compatible application platform, all bolstered by the security and liquidity of Kusama.

Karura (KAR): History and Founders

Karura’s creation is attributed to the team also responsible for Acala Network, consisting of Ruitao Su, Bette Chen, and Bryan Chen.

Ruitao Su, co-founder of Acala, now leads Laminar Protocol as CEO, with a background as a software engineer and CTO of Centrality. Bette Chen, a co-founder of Acala, currently serves as the COO at Laminar, bringing extensive experience in product management within software and high-tech industries.

Bryan Chen, also a co-founder at Acala and Laminar, contributes significantly to the Substrate codebase and is recognized as a Polkadot Ambassador.

Karura Vision and Mission

Karura’s vision and mission revolve around fostering a robust and versatile DeFi ecosystem within the Kusama network. It aims to streamline access to decentralized financial services, making them more efficient, cost-effective, and accessible.

By offering a variety of financial instruments like multi-collateralized stablecoins, liquid staking derivatives, and a decentralized exchange, Karura intends to drive innovation and liquidity in the DeFi space.

This ambition positions Karura as a key player in the Kusama network, contributing to the broader goal of facilitating early-stage deployments and radical innovations in the Polkadot ecosystem.

What Makes Karura (KAR) Unique? Understanding the mains goals

Karura, developed by the Acala team, prioritizes delivering the latest DeFi technologies to its users before other Polkadot platforms. It features a stablecoin, the Karura Dollar (kUSD), pegged to the US dollar, offering alternatives to traditional token exchanges.

The platform enables liquid staking of KSM tokens, including a seven-day unfreezing period, and offers a liquid staking derivative (LKSM) that includes staking rewards. Karura’s wallet supports various coins and NFTs, integrated bridges, borrowing capabilities, and oracles. The platform allows users to implement multiple DeFi strategies, earn fees, and enjoy the benefits of unlocked and liquid KSM staking derivatives.

Karura’s suite includes liquid KSM staking, a decentralized exchange, an algorithmic stablecoin, and a fixed KAR token supply.

Tokenomics and KARURA (KAR) Circulating Supply

Karura is designed specifically for DeFi, utilizing its utility token, KAR, with a capped supply of 100 million. The token’s value is supported by a reserve of ACA tokens.

Distribution of the total supply includes a significant portion (over 60%) for the community, allocations for the founding team, backers, and early supporters. Rewards from the parachain auction are distributed in KAR, with a specific unlocking schedule.

KAR has multiple use cases, such as transaction fees, node incentives, governance, and smart contract deployment, highlighting its integral role in the Karura ecosystem.

Enhance Your Karura (KAR) Management with Klever Wallet

For streamlined management of your Karura (KAR) assets, consider the Klever Wallet. It offers a user-friendly platform for efficiently handling KAR transactions.

Klever Wallet’s interface is designed for simplicity, enabling easy purchasing avail, storing, exchanging, and sending of kar wallet. It’s a favored choice among blockchain enthusiasts for its ease of use and robust features.

Embrace a hassle-free experience with Karura by downloading the Klever Wallet. Join a community that values smooth and secure cryptocurrency management.

Start your journey into effortless KAR handling with Klever Wallet today.