Hey crypto fans.

Hey crypto fans.

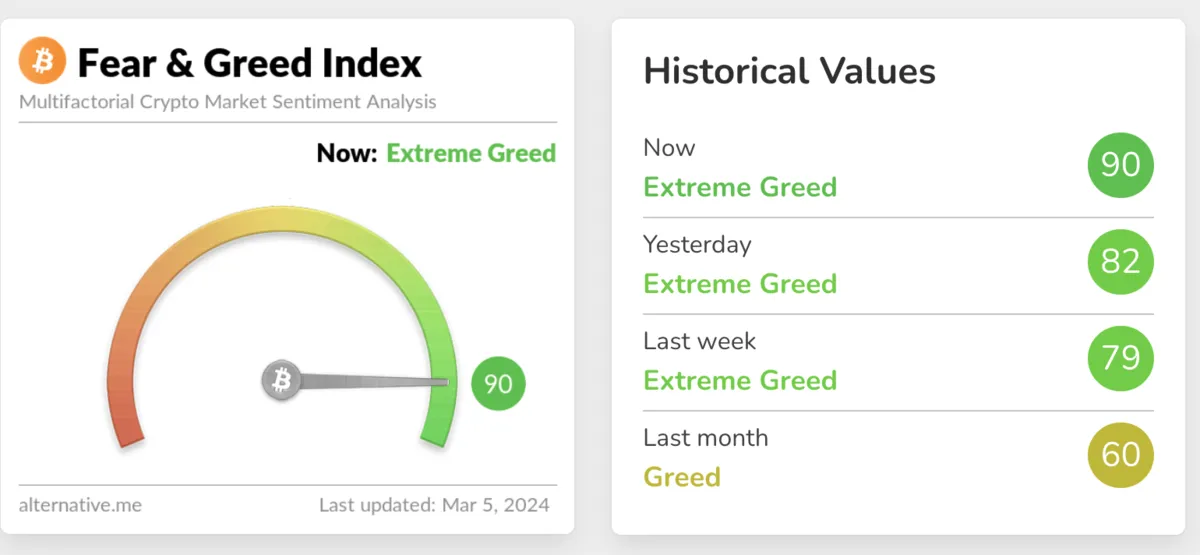

With the recent chatter about Bitcoin reaching its all-time high, many of you might be wondering, what exactly does “all-time high” mean?

Let’s break it down and make it simpler for you to grasp this key piece of crypto lingo.

ATH crypto meaning

“All-time high” (ATH) in the context of cryptocurrency refers to the highest price point that a particular cryptocurrency has ever reached in its trading history. This metric is widely used by investors and analysts to gauge a cryptocurrency’s performance, compare its current price to historical peaks, and evaluate its potential for future growth or correction. When a crypto asset hits its ATH, it often garners increased attention from the media, investors, and the broader market, which can, in turn, influence trading strategies and market sentiment.

Achieving a new ATH is generally viewed as a positive indicator of strong demand and bullish sentiment for the asset.

The relation between BTC Halving and BTC ATH

The relationship between Bitcoin halving and its all-time high (ATH) prices is often attributed to the reduced supply of new Bitcoins entering the market following a halving event. Halving cuts the reward for mining new blocks in half, effectively reducing the rate at which new Bitcoins are created. This decrease in supply, against a backdrop of steady or increasing demand, can lead to price increases, potentially contributing to reaching new ATHs. Historical trends have shown that significant price surges have occurred after past halving events but as Bitcoin’s price approaches its all-time high (ATH) before a halving event, it reflects market optimism and speculative interest in the reduced future supply of Bitcoin.

The correlation between BTC ETF and BTC all-time-high

The launch of a Bitcoin ETF is recognized as a significant factor influencing Bitcoin’s price, potentially driving it to new all-time highs. This is because an ETF makes Bitcoin investment more straightforward and regulated for both institutional and retail investors, eliminating the need for direct interaction with cryptocurrencies. The resulting ease of access increases demand, leading to possible price surges. The positive anticipation surrounding cryptocurrency ETFs historically correlates with market optimism and increased Bitcoin acceptance, underscoring their role in boosting Bitcoin’s market value.

Learn more about What is an ETF and What is BTC on Klever Blog.

In conclusion, understanding the dynamics of ATH, Bitcoin halving, and the impact of Bitcoin ETFs is crucial for anyone involved in the cryptocurrency space. The ATH represents the peak performance of a crypto asset, reflecting market confidence. Bitcoin halving events, by reducing the supply of new Bitcoins, can significantly influence its price and lead to new ATHs due to increased scarcity. Similarly, the introduction of Bitcoin ETFs offers easier access for investors, potentially driving up demand and prices. Together, these factors play a pivotal role in shaping Bitcoin’s market value and investment appeal.

Ready to take your crypto journey to the next level? Dive into the Klever ecosystem and embrace the Bitcoin wave. Effortlessly buy Bitcoin using your credit card, debit card, or bank transfer. Plus, with the option to swap BTC within the same platform, you have everything you need to participate in the Bitcoin momentum.

Download the Klever Wallet and take advantage of the opportunities Bitcoin offers today.