Hey crypto fans.

Hey crypto fans.

Picture this: you woke up today and found out Bitcoin started this August 21st changing hands below $26,000 and you could not believe it by just looking with your eyes. The shock, the disbelief, and the urgent need to know what happened. We’ve all been there, and we understand that you need the hot details, right? We’ve got you covered. In this in-depth exploration, we’ll unravel the multifaceted reasons behind the recent crash in the crypto market.

From the Evergrande crisis to SpaceX’s financial decisions, the Federal Reserve’s report, market sentiment, and other contributing factors, here’s why crypto is down today.

Evergrande Crisis, Rumors Surrounding Tether, and Chapter 15 Filing

Evergrande’s Financial Woes

-

Evergrande, once China’s top-selling developer, faced an unprecedented debt crisis, with debts estimated to total over $300 billion.

-

The world’s most heavily indebted property developer sent shockwaves through global markets.

Chapter 15 Bankruptcy Protection Filing

Evergrande filed for U.S. bankruptcy protection under Chapter 15 on August 18, 2023, as part of a $31.7 billion debt restructuring.

What is Chapter 15?

Chapter 15 is a section of the U.S. Bankruptcy Code that deals with cross-border insolvency and bankruptcy matters. It provides a legal framework for foreign companies to file for bankruptcy in the U.S. court system.

Why Evergrande’s Appeal?

Evergrande’s appeal for Chapter 15 protection was likely a strategic move to negotiate with international creditors and protect its assets in the U.S. It allows the company to work on a debt restructuring plan under U.S. law, potentially providing more favorable terms and facilitating negotiations with creditors.

Rumors and Impact on Cryptocurrencies

-

Concerns arose about Evergrande possibly owing debt in crypto, particularly with Tether – $USDT, the US dollar pegged stablecoin, though the stablecoin supplier denied any relations.

-

The world’s most heavily indebted property developer sent shockwaves through global markets.

The uncertainty surrounding Evergrande contributed to the decline in prices, raising concerns of another potential crypto crash after a recovering period for the crypto market.

SpaceX’s Financial Decisions and Impact on the Crypto Market

SpaceX’s Financial Overview

SpaceX’s financial decisions have recently come under scrutiny, particularly regarding its Bitcoin holdings.

Writing Down Bitcoin Value and Selling

A recent report made by the Wall Street Journal revealed that SpaceX wrote down the value of its Bitcoin holdings by $373 million and sold the cryptocurrency.

Market Reaction and Panic

-

The uncertainty surrounding SpaceX’s actions contributed to a dramatic decline in Bitcoin and the broader crypto market.

-

Bitcoin lost $26,000 and the digital currency market saw over $1 billion in liquidations in less than 24 hours.

Interconnectedness with Other Market Factors

The SpaceX news coincided with other significant events, such as the Evergrande bankruptcy filing and broader macroeconomic concerns.

Federal Reserve’s Report and Its Impact

Fed’s Monetary Policy Statement

Last week, the Federal Reserve released its latest monetary policy statement, outlining its views on the economy, interest rates, and inflation.

Interest Rate Points and Tapering Announcements

-

The Federal Open Market Committee (FOMC) kept the federal funds rate effective at 5.33% as of August 17, 2023.

-

Other key rates include the Bank prime loan at 8.50%, Discount window primary credit at 5.50%, and U.S. government securities Treasury bills (secondary market) ranging from 4.16% for 10-year to 4.41% for 30-year maturities.

-

The report included details about the Fed’s plans to taper its asset purchases, signaling a potential shift in monetary policy.

Impact on Financial Markets

-

The announcement led to mixed reactions in financial markets, including cryptocurrencies.

-

Concerns about tighter monetary policy and potential future interest rate hikes may have contributed to increased volatility and downward pressure on crypto prices.

Market Sentiment and the Emotional Landscape of the Crypto Market

Understanding Market Sentiment

-

Market sentiment refers to the overall attitude of investors toward a particular asset or financial market.

-

It’s often driven by emotion, news, social media, and broader economic factors, and can play a significant role in price movements.

Sentiment During the Recent Crypto Crash

-

Last week’s crash in the crypto market has been marked by a mix of Fear, Uncertainty, and Doubt (often referred to as “FUD”).

-

News about Evergrande’s financial crisis, SpaceX’s Bitcoin sale, and the Federal Reserve’s report contributed to a negative sentiment.

Impact of Social Media and Influencers

-

Social media platforms and key influencers can amplify market sentiment, either positively or negatively.

-

Tweets, posts, and comments can lead to rapid shifts in sentiment, affecting buying and selling behavior.

Sentiment Analysis Tools and Indicators

Fear and Greed Index | Source: @BitcoinFear

-

Fear & Greed Index can provide insights into the prevailing market sentiment.

-

This tool helps investors gauge the emotional state of the market and make informed decisions.

-

As of today, the Fear & Greed Index stands at 38, indicating fear sentiment in the market.

The recent crash in the cryptocurrency market cannot be attributed to a single event or factor. The complex interplay of the Evergrande crisis, SpaceX’s financial decisions, the Federal Reserve’s report, market sentiment, and other contributing elements paints a multifaceted picture of why crypto is down today.

While the recent market downturn has left many investors questioning the stability of digital currencies, the underlying factors and historical resilience of the market prompt analysts and enthusiasts to explore the question: will crypto recover? The answer may lie in understanding the complex interplay of global economic factors, technological advancements, and investor behavior.

Investors and traders must recognize the interconnectedness of traditional and digital finance and the need for careful analysis and risk management. The situation serves as a reminder of the volatile nature of cryptocurrencies and the importance of staying informed and vigilant.

In a world where financial landscapes shift rapidly, understanding the underlying causes of market movements is key to navigating the turbulent waters of investment.

Stay tuned, stay informed, and stay Klever.

Secure Your Digital Assets with Klever Wallet

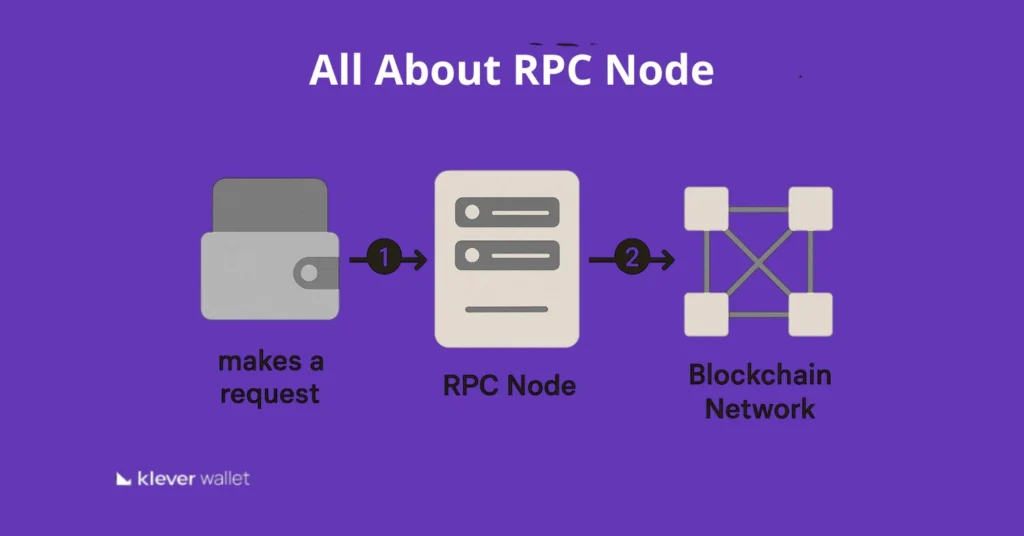

In these uncertain times, securing your digital assets is more crucial than ever. Download the Klever Wallet today and move your assets from exchanges to a safe and secure wallet. With Klever, you can:

Stake Your Assets

Even in a bear market, staking provides an opportunity to earn rewards and take profit. Klever’s staking feature allows you to grow your assets effortlessly.

Swap Crypto Easily

With Klever Wallet, you can swap crypto directly within the app at competitive low fees. Enjoy seamless trading and access to various crypto pairs without leaving the security of your wallet, all while benefiting from cost-effective transactions.

Take Control of Your Investments

Don’t let market volatility dictate your financial future.

With Klever, you have the power to take profit even in a bear market, ensuring that you stay ahead of the game.

Experience Unmatched Security

Klever Wallet’s cutting-edge security features ensure that your digital assets are protected, giving you peace of mind in an ever-changing market landscape.

Stay Informed

With real-time updates and market insights, Klever keeps you informed, helping you make wise investment decisions.

Don’t wait for the market to decide your fate. Download Klever Wallet now and take control of your financial future. Secure your digital assets, stake with confidence, and thrive even in the most challenging market conditions.