Hey crypto fans.

Hey crypto fans.

Feeling the buzz around the upcoming Bitcoin Halving? There’s a whirlwind of predictions out there – some Bitcoin aficionados and market analysts are forecasting a surge to $100K, while the skeptics and bears warn it might plummet to $12K. What’s your take on this rollercoaster of speculation? Will Bitcoin soar to new heights, or is a dip on the horizon? Got questions about bitcoin halving and how it might affect Bitcoin’s price? You’re in the right place.

What is bitcoin halving ?

Bitcoin halving is a critical event that occurs every 210,000 blocks, roughly every four years, which reduces the reward for mining new blocks by half. This mechanism ensures that the total supply of Bitcoin caps at 21 million, aiming to prevent inflation.

Why does bitcoin halving matters?

Bitcoin halving is important because it helps keep Bitcoin valuable and stable. When the halving happens, miners get half the reward they used to for processing transactions, which means fewer new bitcoins are made. This makes bitcoins rarer, which can increase their demand and price, good news for people holding them long-term. Halving shows that Bitcoin is growing up as a digital money system, different from regular money because it doesn’t lose value over time. It can make mining less profitable, which might affect how secure and spread out the Bitcoin network is. In short, halving is a key part of what makes Bitcoin special, influencing how people see and invest in it.

What happens when bitcoin halves?

When Bitcoin halves, the reward that miners receive for adding new transactions to the blockchain is cut in half. This means they get 50% less Bitcoin for their efforts. This event happens every four years and is designed to slowly reduce the number of new bitcoins being created until there are 21 million in total. As a result, Bitcoin becomes more scarce, which can make its value go up because there are fewer new bitcoins available. This can also make mining less profitable, leading some miners to stop unless the value of Bitcoin increases to offset the lower rewards.

How Bitcoin ETFs Make Investing Easier and Affect Prices Before the Halving

Bitcoin ETFs (Exchange-Traded Funds) have really changed how people invest in Bitcoin. These ETFs let people invest in Bitcoin’s value without having to buy the actual cryptocurrency. This is great because it’s simpler and doesn’t involve the tricky part of handling and keeping Bitcoin safe.

Because ETFs are easier and have rules that make investors feel safer, more people, including big companies and regular folks, are investing in Bitcoin. This new wave of investors increases demand, which can push up Bitcoin’s price.

Also, having Bitcoin in the form of ETFs makes it more accepted and seen as a real type of investment. This helps more people get involved and supports Bitcoin’s growth into something that many more people use and invest in.

Please note: While investing in Bitcoin ETFs offers an accessible and straightforward path to engage with Bitcoin’s value, it’s important to remember that you only truly own Bitcoin when you have direct custody of it. ETFs represent an investment in Bitcoin’s market performance, not ownership of the actual cryptocurrency. For full ownership, consider holding Bitcoin in a personal wallet where you control the private keys. This ensures that the Bitcoin is yours, with all the rights and responsibilities that come with direct possession. Your keys, Your coins!

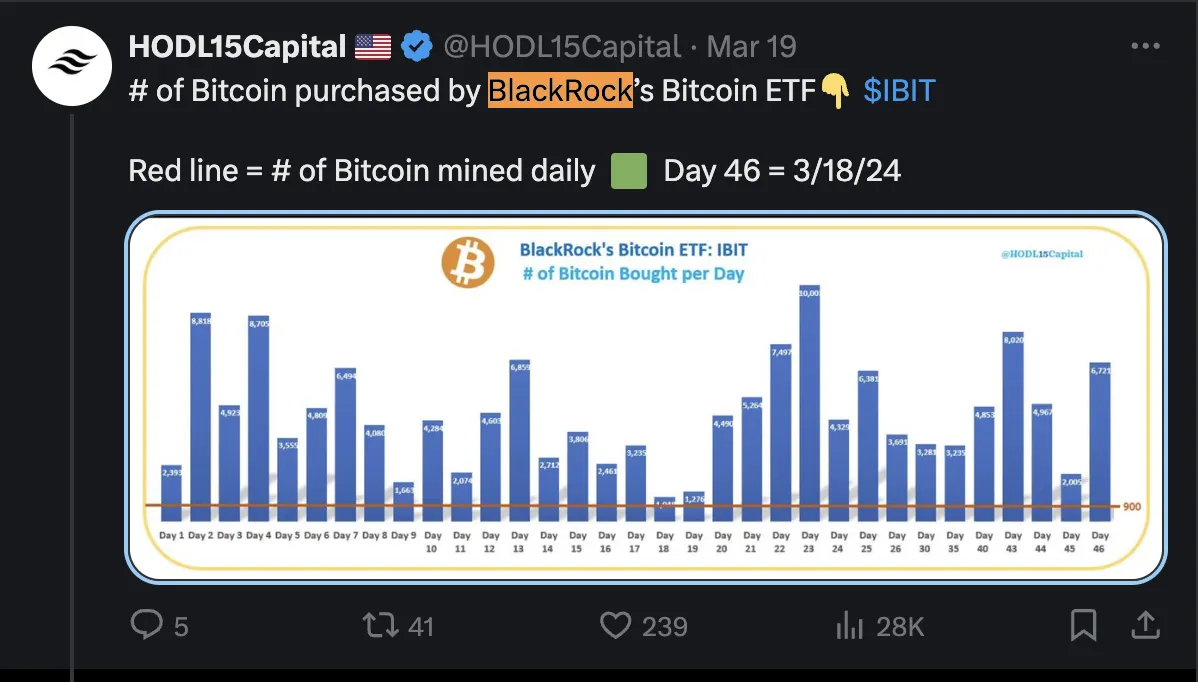

How Big Investors Like BlackRock Influence Bitcoin’s Market

Institutional interest, like that from large entities such as BlackRock, holding a substantial portion (e.g., 1% of all bitcoins), can increase Bitcoin’s price before a halving event due to a few key reasons:

Anticipation and Speculation: As the halving approaches, the market generally anticipates a decrease in the new supply of Bitcoin, which can lead to an increase in price due to expected scarcity. When large institutions invest heavily in Bitcoin, it amplifies this anticipation. Their involvement is seen as a vote of confidence in Bitcoin’s value post-halving, encouraging more investors to buy in before the event.

Increased Demand: Institutional investments pour substantial new capital into the Bitcoin market, increasing demand. This is especially significant in the months leading up to a halving, as the market speculates on the reduced future supply. The larger the players entering the market, the more pronounced this effect can be.

Market Sentiment: The entry of recognized financial institutions into the Bitcoin space improves overall market sentiment. It validates BTC as a credible investment, attracting more attention and investment from retail and other institutional investors. This heightened interest and positive sentiment can drive up prices as the halving event nears.

Liquidity and Market Depth: Large institutional buys contribute to greater liquidity and market depth, making the market more robust and capable of sustaining higher prices. This is particularly important in the volatile periods leading up to a halving, as it can help stabilize price swings and provide a foundation for upward price movement.

Together, these factors contribute to a pre-halving price increase, as institutional investment ahead of these events signals confidence in Bitcoin’s long-term value, encouraging broader market participation and driving up prices in anticipation of the reduced supply post-halving.

Ready to navigate the Bitcoin halving? Klever is here to support you every step of the way. Start buying BTC from top-notch sources, enjoying a broad range of payment choices. Safely store your Bitcoin in our user-friendly hot wallet. And if you’re in the market for offline security, KleverSafe has you covered. Secure your bitcoins in a btc hardware wallet and rest easy knowing you’re prepared for the halving. Don’t wait—take action with Klever today!

Download Klever Wallet now!