Market cycles are a fundamental concept in economics and investing, and the crypto market is no exception. A market cycle refers to the periodic rise and fall of prices, typically characterized by phases of expansion (bull markets) and contraction (bear markets).

In the crypto world, these cycles can be particularly volatile due to the market’s relatively young age, 24/7 operation, and sensitivity to a variety of factors. This volatility often leads to the question: will crypto recover? While it’s impossible to predict with certainty, understanding these market cycles can provide real insight into potential recovery patterns.

The crypto volatility can be attributed to several factors:

-

Market Size: The crypto market is relatively small compared to traditional financial markets. This means it’s more susceptible to price swings caused by large trades.

-

Regulation: The regulatory environment for cryptocurrencies is still developing and can vary greatly by country. News about regulatory changes can cause significant price movements.

-

Technology Development: Cryptocurrencies are based on new and rapidly evolving technology. News about technological advancements or issues can influence prices.

-

Market Sentiment: The crypto market is heavily influenced by sentiment, which can be affected by a range of factors, from media coverage to the actions of influential individuals. This sentiment can be bullish, indicating optimism and the expectation of price increases, or bearish, indicating pessimism and the expectation of price decreases.

-

Consensus Mechanisms: The underlying technology of cryptocurrencies, blockchain, relies on consensus mechanisms like Proof of Work (PoW) and Proof of Staking (PoS), for example, to validate transactions and add new blocks to the chain. Changes or issues related to these mechanisms can also affect market prices.

Historical Market Recoveries

The crypto market’s history reveals its resilience, consistently bouncing back from downturns. The “crypto winter” of 2018 saw a significant downturn, with Bitcoin’s all-time high (ATH) of nearly $20,000 in late 2017 dropping significantly, along with other cryptocurrencies like Ethereum and Litecoin.

However, by 2019, the market began to rebound, and by 2020, it was in a new bull run. Bitcoin reached a new ATH of over $60,000, Ethereum surpassed $4,000, and altcoins like $KLV saw substantial growth, reaching an ATH of $0.16.

The crypto crash of 2022 was another significant event, causing a sharp decline in many cryptocurrencies. However, as with previous downturns, the market showed its resilience and began to recover.

Understanding Halving

What is crypto halving?

In the context of cryptocurrencies, halving refers to the reduction of block rewards given to miners by half. This event occurs at pre-set blocks, meaning it happens after a specific number of blocks have been mined. The halving mechanism, first implemented in Bitcoin, is now adopted by many other cryptocurrencies. Its primary purpose is to control token supply and prevent inflation.

The Impact of Halving Events

Halving events, unique to the crypto market, are pre-programmed reductions in the rewards given to miners on certain blockchain networks, such as Bitcoin and Litecoin. These networks use the Proof of Work (PoW) consensus mechanism, and halving events are significant because they limit the rate of new coin creation. This supply reduction can increase demand if interest in the cryptocurrency remains strong, potentially leading to higher prices. However, while halving events have historically been associated with price increases, they are not the only factor influencing a cryptocurrency’s price. Market sentiment, regulatory changes, and technological advancements also play crucial roles in shaping market dynamics.

Bitcoin Halving

Bitcoin, being the first cryptocurrency, has undergone three halving events in its history. The first halving occurred in November 2012, reducing the block reward from 50 to 25 bitcoins. The second halving, in July 2016, further reduced the reward to 12.5 bitcoins. The most recent Bitcoin halving occurred in May 2020, reducing the block reward from 12.5 to 6.25 bitcoins. Each halving event has been followed by a significant increase in price, leading many to speculate that halving events trigger bull runs. The next Bitcoin halving is expected to occur in 2024.

Litecoin Halving

Litecoin, another popular cryptocurrency, also undergoes halving events. The latest Litecoin halving occurred on August 2, 2023, reducing the block reward from 12.5 to 6.25 Litecoins. Following the event, the price retraced back to $81 by the time of writing this article. While it’s too early to determine the full impact of this event, it’s worth noting that Litecoin’s price has historically increased following halving events. However, other market factors can also influence price movements, and past performance is not a guarantee of future results.

Current Market Indicators

Despite the downturn, the crypto market’s fundamentals remain strong due to ongoing innovation and rapid project launches. Institutional interest and investment in crypto is growing, potentially driving market recovery. Public sentiment, though shaken, remains largely positive, with many recognizing the potential of cryptocurrencies and blockchain technology, maintaining a bullish outlook despite the market’s volatility.

The Journey of $KLV (Klever)

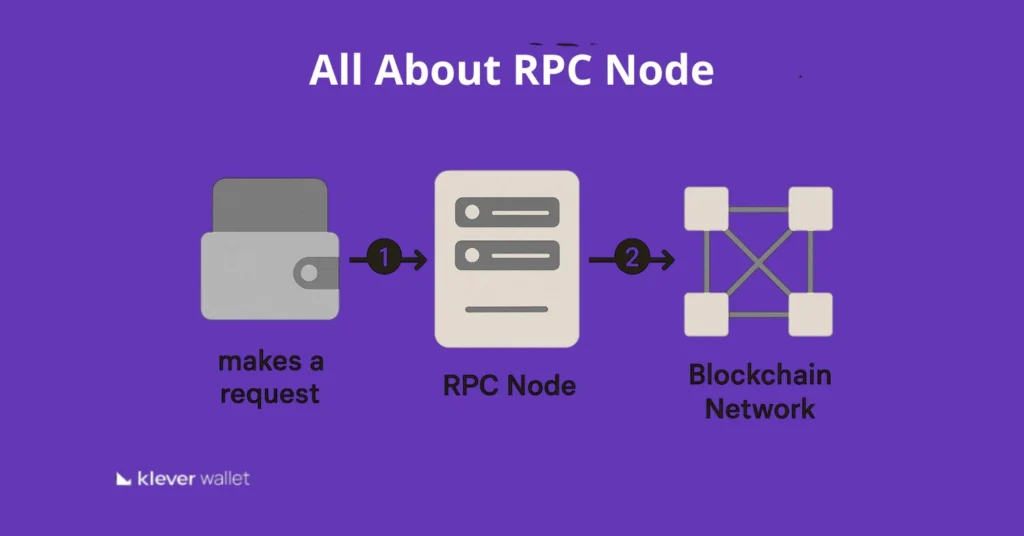

$KLV (Klever Coin) has carved its unique trajectory in the dynamic crypto landscape. As the utility token of the Klever ecosystem, $KLV is crucial for operations, facilitating efficient transactions. It’s used for transaction fees, staking, and governance within the Klever Wallet, and for network fees and smart contract interactions on KleverChain.

The price volatility of $KLV is influenced by a multitude of factors. Among these, the rate of adoption of Klever’s wallet and services, as well as the broader trends and dynamics in the crypto market, play crucial roles.

While the Klever ecosystem is continuously evolving, it’s the market forces and user adoption that primarily drive KLV’s value fluctuations. Another key influence is Bitcoin, whose price movements often guide the entire crypto market, including altcoins like $KLV. This correlation, while not absolute, is a significant consideration for those interested in the crypto space.

Understanding $KLV and its role within the Klever ecosystem and the wider crypto market involves navigating these complex influences. A comprehensive understanding of both the ecosystem and the market is essential, with decisions grounded in thorough research and careful consideration of the crypto space’s inherent volatility.

While the current market downturn may be concerning, it’s important to remember that volatility is a fundamental characteristic of the crypto market. Market cycles of boom and bust are common, and while they can be challenging to navigate, they also present opportunities for those who understand them.

Looking at the history of the market, the resilience of the crypto community, and the ongoing innovation in the space, there are reasons to be optimistic about the future. Whether you’re a seasoned participant or new to the crypto world, understanding these market cycles and the factors that drive them can help you navigate this dynamic and exciting market.

To safeguard your assets from crypto volatility, consider downloading the Klever Wallet. It offers a secure and user-friendly platform for managing your cryptocurrencies and staying updated with market trends.