Hey crypto fans,

Exchange-Traded Funds (ETFs), a mainstay in traditional finance, offer a convenient way to invest in a basket of assets. Yesterday, the financial world witnessed a landmark moment with the approval of Bitcoin ETFs, merging the cryptocurrency and traditional investment worlds.

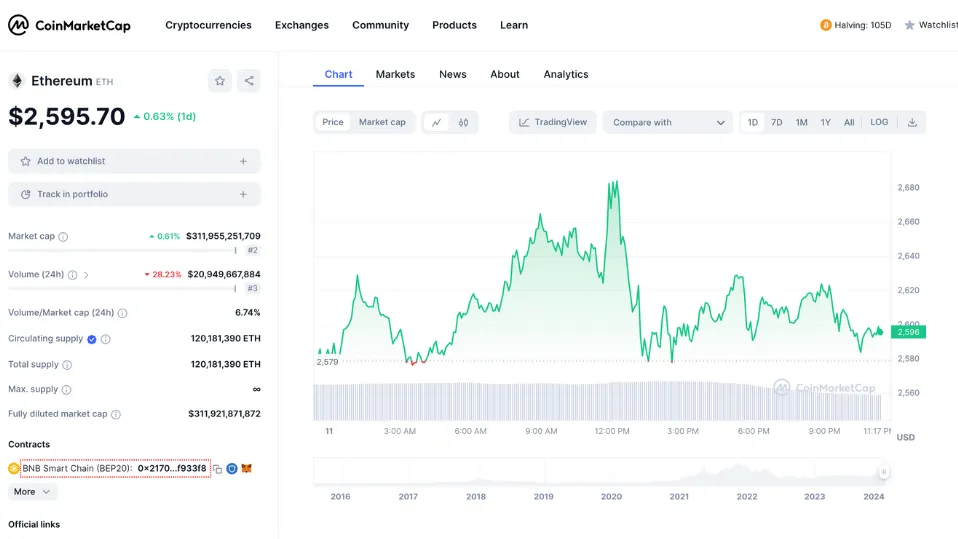

Following the approval of Bitcoin ETFs, Ethereum’s price witnessed a significant upsurge, surpassing the $2,500 mark, which marked its highest point since May 2022. This increase in Ethereum’s price, which outperformed Bitcoin’s price movement, is attributed to several factors.

Primarily, the approval of Bitcoin ETFs fueled speculation and hope among investors that Ethereum ETFs could be next in line for approval. This sentiment was bolstered by a substantial 108% surge in Ethereum’s trading volumes, according to CoinMarket Cap, reflecting strong investor interest in the cryptocurrency.

The rise in Ethereum’s value in the wake of Bitcoin ETF approvals illustrates the interconnected nature of the cryptocurrency market. It also highlights how regulatory moves in one part of the crypto ecosystem can have ripple effects across other cryptocurrencies. Ethereum’s spike in value reflects the market’s optimism about the future of Ethereum ETFs and the broader acceptance of cryptocurrencies in the mainstream financial world.

An Ethereum ETF could unlock new opportunities for investors, offering a regulated and straightforward means to tap into the potential of Ethereum without direct cryptocurrency engagement. This development is not just a fleeting trend but a significant stride in integrating blockchain technology with conventional investment platforms.

For those intrigued by Ethereum’s possibilities, it’s a space worth watching. Let’s get into it.

Ethereum ETF Background and Current State

BlackRock, the world’s largest asset manager, made a significant move in the cryptocurrency space by officially filing for a spot Ethereum exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission (SEC) on November 16, 2023. This ETF, known as iShares Ethereum Trust, is intended to give investors exposure to Ethereum without the need to directly own the cryptocurrency.

The filing followed BlackRock’s registration of the entity iShares Ethereum Trust with the Delaware Department of State Division of Corporations and the submission of a 19b-4 filing with Nasdaq.

This strategic step by BlackRock into Ethereum highlights the growing interest of traditional financial institutions in the crypto space. By proposing a spot ETF, which would own Ethereum directly instead of futures products tied to the token, BlackRock is signaling its belief in the viability and potential of Ethereum as an investment.

The move comes amid a broader push in the industry for such investment vehicles, following a landmark victory for Grayscale Investments in creating a spot Bitcoin ETF.

The Case for Ethereum ETFs

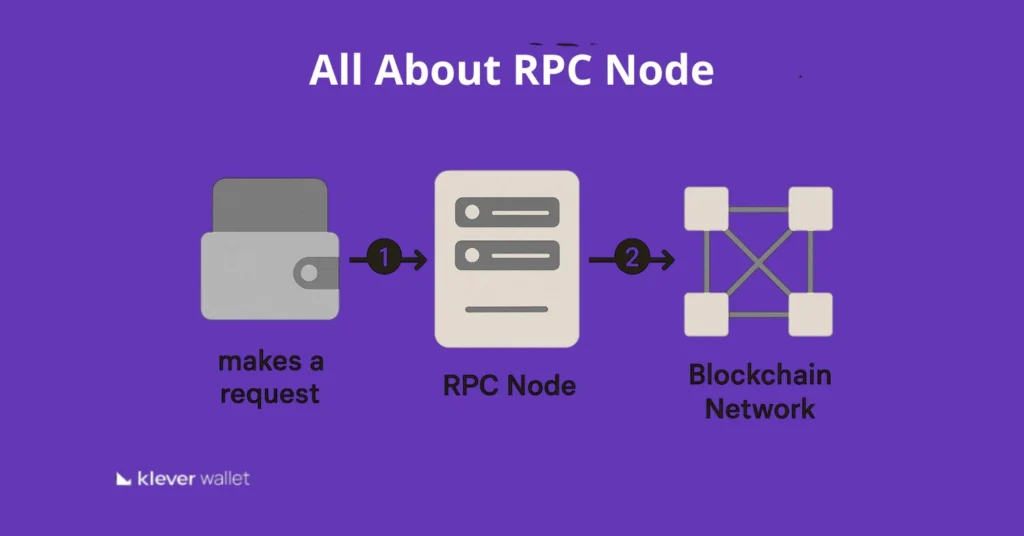

The burgeoning interest in Ethereum ETFs stems from several compelling benefits. Firstly, these ETFs promise to enhance accessibility for traditional investors. By packaging Ethereum in a familiar ETF structure, it becomes more approachable for those accustomed to traditional finance, eliminating the responsibilities of managing their own cryptocurrency wallets and exchanges.

Ethereum ETFs also offer the advantage of diversification. While Bitcoin represents digital gold, Ethereum’s role as a platform for decentralized applications – DApps and smart contracts introduces a different investment profile. This diversification can be particularly appealing to investors seeking exposure to varied aspects of the blockchain ecosystem.

Klever Drop: Klever Wallet provides a whole functional and user-friendly platform for ETH. Manage your tokens with an ETH Wallet, seamless Send, Receive and Swap Ether, access Ether Dapps via Klever Browser, Play with the grown ups with KleverSafe and offline storage of your ETH private keys.

Industry experts and analysts are optimistic about the potential of Ethereum ETFs for mainstream adoption. The approval of Ethereum futures ETFs has been seen as a stepping stone, indicating regulatory bodies’ increasing comfort with cryptocurrency as an asset class. This development is expected to pave the way for spot Ethereum ETFs, further integrating Ethereum into the broader financial market.

Potential Impact on Ethereum Price and the Broader Market

(Source: CoinMarket Cap – January 11th 2024)

The approval of Ethereum ETFs could have a significant impact on both Ethereum’s market dynamics and the broader cryptocurrency sector. Market response to such approval is likely to be positive, just like right after Bitcoin Spot ETF Approval, where ETH price jumped to the $2500 area, potentially leading to increased price stability and higher trading volumes for Ethereum.

Investor sentiment already experiences a boost, as ETFs offer a safer and more regulated investment vehicle, thereby attracting a new wave of investors who were previously hesitant to dive into the cryptocurrency market directly.

The ripple effects would extend beyond Ethereum. Altcoins and the decentralized finance (DeFi) space could experience heightened interest as Ethereum ETFs validate the legitimacy and potential of blockchain technology. This could lead to increased investment and innovation in these areas.

In the long term, the successful integration of Ethereum into traditional finance through ETFs could significantly accelerate the adoption of blockchain technology and decentralized finance. It would demonstrate the practical utility of blockchain beyond speculative trading, potentially spurring new use cases and mainstream acceptance of these technologies. This could be a key milestone in the journey of blockchain technology from a niche interest to a foundational component of the global financial system.

In conclusion,

The journey towards Ethereum ETFs represents a pivotal moment in the intersection of traditional finance and the innovative world of cryptocurrencies. These ETFs hold immense potential to bring Ethereum into the mainstream investment fold, offering a regulated, familiar avenue for exposure to this leading blockchain technology.

However, this path is not without its challenges, including regulatory hurdles and the inherent volatility of the crypto market.

For those interested in direct ownership of Ethereum, Klever Wallet offers a user-friendly platform and a complete blockchain hub for your transactions – translating: security and easy management at your fingertips. Although, if your prever to manage your finances only via notebook, with next month’s release on the Klever Extension, desktop users will be able to easily buy ETH assets with total safety, and in a Klever Way. These options are ideal for those who prefer the tangible ownership of their digital assets, offering a contrast to the indirect exposure provided by ETFs.

Stay tuned for more updates.

Be Your Own Bank – Be Klever