The U.S. Securities and Exchange Commission (SEC) has consistently been skeptical about cryptocurrencies, and its decision to approve a bitcoin ETF doesn’t significantly alter this position.

Following the ETF approval, SEC Chairman Gary Gensler released a statement labeling bitcoin as a “speculative” asset, highlighting its potential use in “illicit” activities.

One thing is certain: the approval of the Bitcoin ETF is a significant milestone for the cryptocurrency market, potentially paving the way for ETFs of other cryptocurrencies, such as Ethereum.

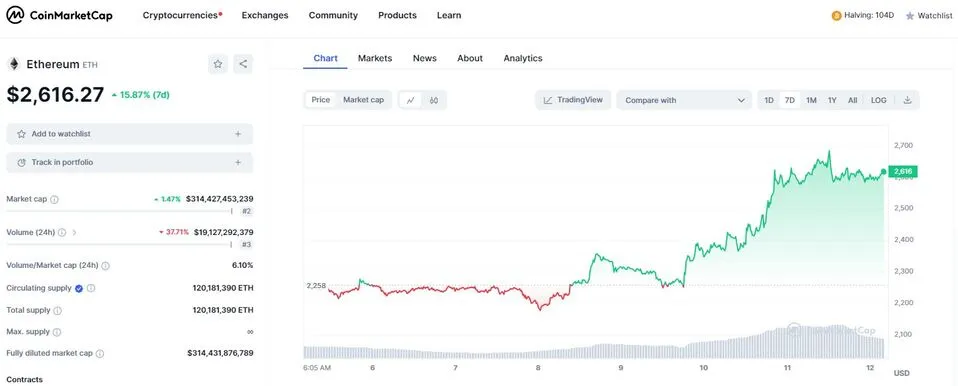

Shortly after the Bitcoin ETF was approved on Wednesday afternoon (10th), the cryptocurrency surged 8.1%, reaching U$2,618.16.

Understanding more about Ethereum

Ethereum, often referred to by its cryptocurrency ticker ETH, is a decentralized, open-source blockchain system. It’s second only to Bitcoin in terms of popularity and market capitalization. However, Ethereum differs significantly from Bitcoin in its functionality and purpose.

Here are some key aspects of Ethereum that we Klever undestand that are the most relevant nowdays:

-

Smart Contracts: Ethereum’s most notable feature is its ability to execute smart contracts. Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. They automatically enforce and execute the terms of a contract when certain conditions are met.

-

Ethereum Virtual Machine (EVM): Ethereum introduces a unique feature called the Ethereum Virtual Machine, which is a complete software platform that allows developers to build and deploy decentralized applications (dApps). The EVM makes the process of creating blockchain applications much easier and more efficient than ever before.

-

Decentralized Applications (dApps): Ethereum enables the development and operation of decentralized applications. These are applications that run on a blockchain or P2P network of computers instead of a single computer, and they are outside the purview and control of a single authority.

-

Decentralized Finance (DeFi): Ethereum has been foundational in the rise of the Decentralized Finance (DeFi) movement. DeFi uses smart contracts to create protocols that replicate existing financial services in a more open, interoperable, and transparent way.

-

Non-Fungible Tokens (NFTs): Ethereum is also widely used for creating and trading NFTs, which are unique digital assets verified using blockchain technology.

Ethereum’s flexibility and its broad range of use cases have made it a popular platform for innovation in the blockchain space.

Why did the price of ethereum skyrocketed after the bitcoin etf was approved?

Currently being the second-largest cryptocurrency in the world, Ethereum holds significant importance in the market, as we have recently seen.

The answer to why Ethereum has grown so much in recent days is actually relatively straightforward. Now that the Bitcoin ETF has finally been approved, the eyes of both retail and institutional investors, who often have substantial funds, are turning towards ETH.

This means that the next ETF likely to be up for potential approval is that of Ethereum. The greater truth is that we are just at the beginning, as the trend suggests that ETFs of other important cryptocurrencies may also be approved in the coming years.

There has already been much discussion among analysts and investors about other cryptocurrencies beyond Ethereum and Bitcoin, such as XRP, Solana, and ADA Cardano.

Regarding Ethereum specifically, there are already several ETF applications for the second-largest cryptocurrency in the market. BlackRock, which manages nearly $9 trillion in assets, officially filed for an Ethereum (ETH) spot ETF with the U.S. Securities and Exchange Commission (SEC) on November 16, 2023.

Last week, the investment giant had registered the product, named iShares Ethereum Trust, in the state of Delaware, USA, which caused the price of ETH to exceed $2,000 at that time.

The company chose Coinbase Custody Trust Company as the custodian of the exchange-traded fund, which aims to “generally reflect the performance of Ethereum’s price,” according to the form submitted to the U.S. capital market’s regulator.

What the approval of an Ether ETF could cause?

One of the positive impacts of this process would be an increase in credibility not only for Ethereum but also for the digital assets that are part of the ecosystem, such as Layer 1s, Layer 2s, and others. After all, SEC approval would act as a ‘green light’ for major organizations in the country to engage in this market.

Furthermore, asset managers would need to acquire large amounts of ETH to back the shares of an exchange-traded fund. Consequently, this would likely increase the liquidity and, very likely, the value of these crypto assets.

“The approval of the first Bitcoin spot ETF in the United States has the potential to bring several trillion dollars from institutional investors into this market,” states Vinicius Bazan, head of cryptocurrency analysis at Empiricus Research.

Therefore, in addition to the Bitcoin ETF approval bringing more liquidity to the market by itself, a potential approval of an ETH ETF would further increase market growth. As discussed earlier, cryptocurrencies linked to Ethereum could naturally benefit from this.

For this reason, it’s important to have an Ethereum wallet to securely store your crypto assets. With the Klever wallet, you can purchase Ethereum, perform swaps, staking, send your ETHs, and much more.